Mastering Your Finances With The Mint Budget App: A Comprehensive Guide

The Mint Budget App has become a staple for individuals looking to take control of their finances in today's fast-paced world. With its user-friendly interface and robust features, Mint not only simplifies budgeting but also provides valuable insights into spending habits. In this article, we will explore the various functionalities of Mint, its benefits, and how it can empower you to achieve your financial goals.

In an age where financial literacy is more crucial than ever, tools like the Mint Budget App serve as essential resources. This app allows users to track their expenses, set budgets, and ultimately save money effectively. Whether you're a student managing your limited funds or a professional planning for retirement, Mint can cater to your unique financial needs.

As we delve deeper into the features of the Mint Budget App, you'll discover how to leverage this tool to gain a better understanding of your financial landscape. From detailed analytics to easy integration with bank accounts, Mint is designed to help you make informed financial decisions.

Table of Contents

- What is the Mint Budget App?

- Key Features of the Mint Budget App

- Benefits of Using the Mint Budget App

- How to Use the Mint Budget App

- Security and Privacy in the Mint Budget App

- User Reviews and Testimonials

- Mint Budget App vs. Other Budgeting Apps

- Conclusion

What is the Mint Budget App?

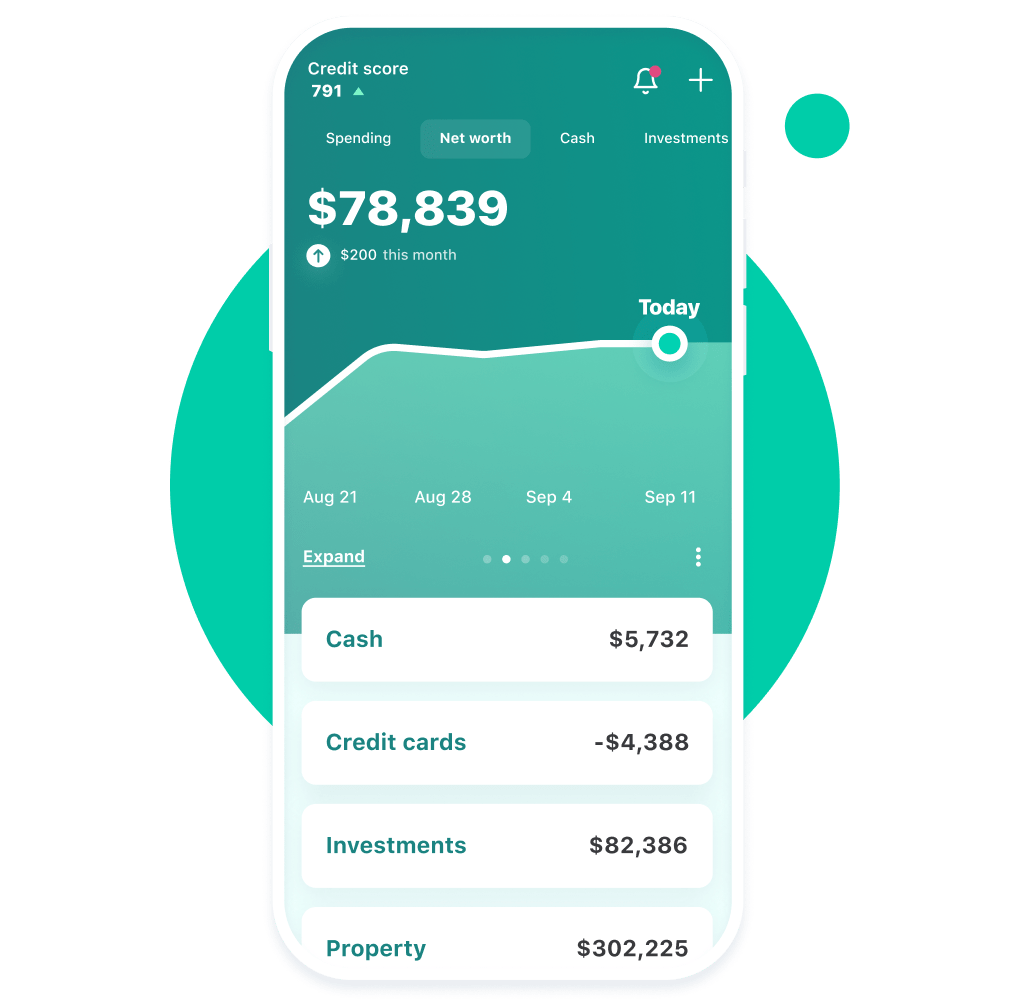

The Mint Budget App, developed by Intuit, is a free personal finance management tool that helps users track their spending and savings. Launched in 2006, Mint has evolved into a comprehensive budgeting platform that syncs with bank accounts, credit cards, and investment accounts. Users can view all their financial information in one place, making it easier to manage their finances.

Mint Budget App Overview

- Launch Year: 2006

- Developer: Intuit

- Platforms: Web, iOS, Android

- Cost: Free

Key Features of the Mint Budget App

The Mint Budget App is packed with features designed to simplify financial management. Here are some of the standout functionalities:

1. Expense Tracking

Mint allows users to categorize their expenses automatically by syncing with bank accounts. This feature provides a clear picture of where money is being spent, helping users identify areas for improvement.

2. Budgeting Tools

With Mint's budgeting tools, users can set spending limits for different categories and receive alerts when they approach these limits. This proactive approach encourages responsible spending habits.

3. Credit Score Monitoring

The app provides users with free access to their credit scores and credit reports, enabling them to monitor their credit health regularly. Understanding credit scores can help users make informed borrowing decisions.

4. Bill Tracking

Mint helps users keep track of upcoming bills and due dates, reducing the risk of late payments and associated fees. Users can set reminders to ensure timely payments.

Benefits of Using the Mint Budget App

Using the Mint Budget App offers numerous advantages that can significantly impact your financial well-being:

- Increased Financial Awareness: By visualizing spending patterns, users become more conscious of their financial habits.

- Improved Savings: Setting budgets and goals helps users save money more effectively.

- User-Friendly Interface: Mint's intuitive design makes it accessible for users of all ages and technical backgrounds.

- Comprehensive Financial Overview: Users can view all their financial accounts in one place, streamlining financial management.

How to Use the Mint Budget App

Getting started with the Mint Budget App is straightforward. Follow these simple steps to begin your financial journey:

- Download the App: Available on both iOS and Android platforms, download the app from the respective app store or access it via the web.

- Create an Account: Sign up for a free account using your email address and create a secure password.

- Link Your Financial Accounts: Sync your bank accounts, credit cards, and loans to enable automatic tracking.

- Set Your Budgets: Customize your budget categories based on your spending habits.

- Monitor Your Progress: Regularly check your dashboard to track your expenses and savings goals.

Security and Privacy in the Mint Budget App

Security is a top priority for Mint. The app employs bank-level encryption and multi-factor authentication to protect user data. Additionally, Mint does not sell personal information to third parties, ensuring that your financial data remains private.

Data Protection Measures

- 256-bit AES Encryption: Encrypts sensitive data to prevent unauthorized access.

- Multi-Factor Authentication: Adds an extra layer of security during login.

- Privacy Policy: Clearly outlines how user data is used and protected.

User Reviews and Testimonials

Many users have shared their positive experiences with the Mint Budget App. Here are some highlights from user testimonials:

- "Mint has transformed how I manage my finances. It's easy to use and keeps me accountable!"

- "The expense tracking feature is a game-changer. I can see exactly where my money goes each month."

- "I love the credit score monitoring! It helps me stay on top of my financial health."

Mint Budget App vs. Other Budgeting Apps

While there are several budgeting apps available, Mint stands out for its comprehensive features and user-friendly design. Here’s a quick comparison:

| Feature | Mint | Other Apps |

|---|---|---|

| Expense Tracking | Yes | Varies |

| Credit Score Monitoring | Yes | No |

| Bill Tracking | Yes | Limited |

| Free Version | Yes | No |

Conclusion

In conclusion, the Mint Budget App is a powerful tool for anyone looking to enhance their financial management skills. Its intuitive design, robust features, and commitment to security make it a top choice for users of all backgrounds. By leveraging the capabilities of Mint, you can gain valuable insights into your spending habits, set achievable financial goals, and ultimately take control of your financial future.

We invite you to try the Mint Budget App today and experience the benefits for yourself. Feel free to leave a comment below with your thoughts or share this article with friends who might benefit from better budgeting tools. Don't forget to check out our other articles for more financial tips and insights!

Thank you for reading, and we look forward to seeing you back here for more valuable content!

Jamaal Charles: The Journey Of An NFL Superstar

Ultimate Guide To Fantasy Basketball Trade Analyzer

Latest Developments In Wells Fargo News: What You Need To Know