Understanding Google Stock Market: A Deep Dive Into Alphabet Inc.'s Financial Landscape

The Google stock market is one of the most talked-about topics in the financial world today. As a subsidiary of Alphabet Inc., Google has significantly influenced the technology sector and the overall stock market. This article aims to provide a comprehensive overview of Google's stock performance, its impact on investors, and the factors driving its valuation.

With the rise of digital advertising, cloud computing, and innovations in artificial intelligence, Google has become a cornerstone of the global economy. Understanding how Google’s stock operates is crucial for both seasoned investors and those new to the stock market. This article will explore everything from historical performance to future forecasts, making it an essential read for anyone interested in investing in tech stocks.

In this article, we will cover various aspects of Google stock, including its market trends, financial metrics, and how it compares to competitors. By the end, you will have a well-rounded understanding of what makes Google stock a valuable asset in the market.

Table of Contents

- Historical Performance of Google Stock

- Key Financial Metrics

- Current Market Trends

- Factors Influencing Google Stock Price

- Competitor Analysis

- Future Forecasts for Google Stock

- Investor Strategies for Google Stocks

- Conclusion

Historical Performance of Google Stock

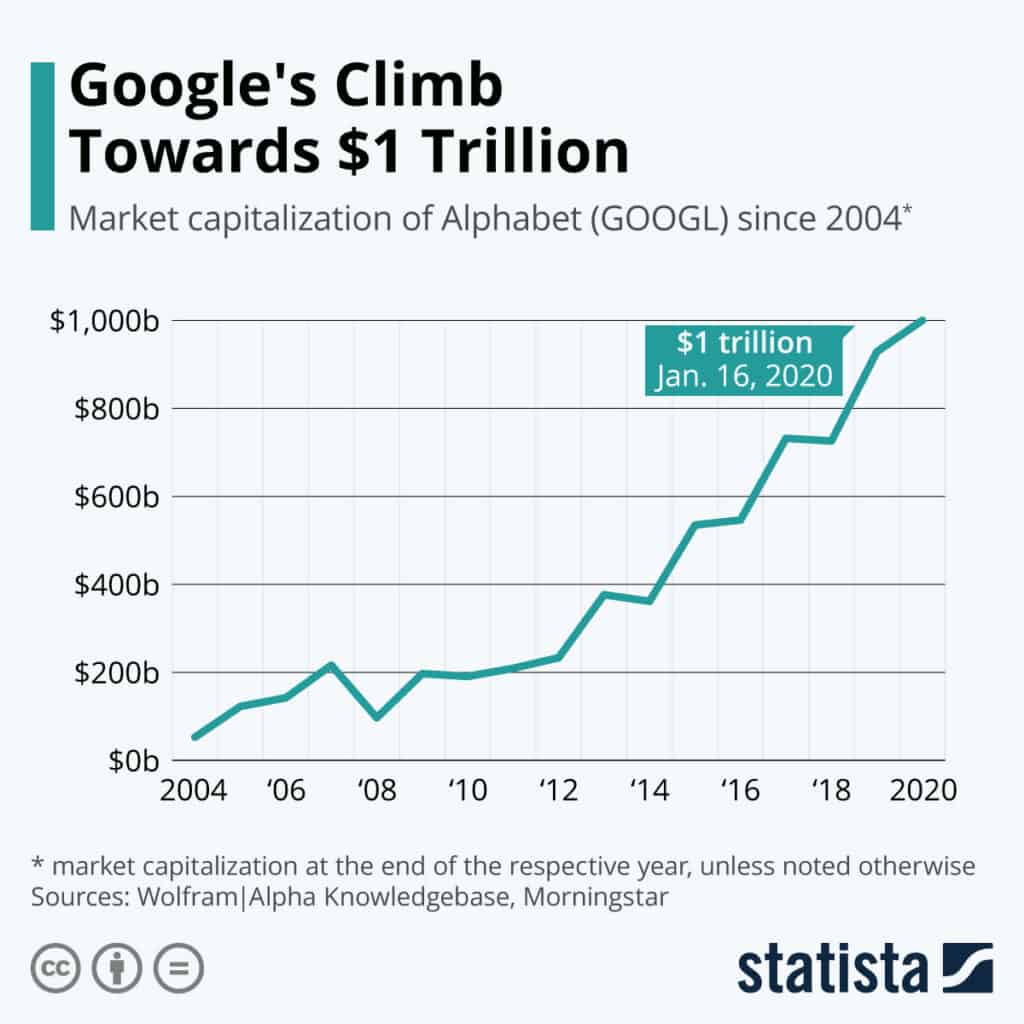

Google went public on August 19, 2004, with an initial public offering (IPO) price of $85 per share. Since then, the stock has shown remarkable growth, reflecting the company’s dominance in the tech industry. Here are some key milestones:

- 2004-2010: The stock price steadily increased, reaching $600 by 2010.

- 2010-2020: Google stock split in April 2014, allowing for more accessibility to investors.

- 2020-Present: The stock has experienced fluctuations but has generally trended upward, especially during the pandemic as digital services surged.

Key Financial Metrics

To understand the health of Google stock, it's essential to look at its financial metrics. Here are some key indicators:

| Metric | Value |

|---|---|

| Market Capitalization | $1.5 Trillion (as of October 2023) |

| P/E Ratio | 25.3 |

| Revenue (2022) | $279 Billion |

| Net Income (2022) | $76 Billion |

These metrics reflect Google’s strong performance and its capability to generate substantial revenue, making it a robust investment option.

Current Market Trends

As of late 2023, Google stock has been influenced by various market trends:

1. Digital Advertising Growth

Google remains a leader in digital advertising, capturing significant market share. The increasing shift towards online marketing has bolstered its revenue streams.

2. Cloud Computing Expansion

Google Cloud is rapidly growing, contributing to the overall growth of the company. The demand for cloud services continues to rise as more businesses digitize their operations.

3. Regulatory Scrutiny

Increased scrutiny from regulators globally poses challenges that could affect stock performance. Investors should keep an eye on any legal developments.

Factors Influencing Google Stock Price

Several factors can influence the price of Google stock:

- Market Sentiment: Investor perception and news can significantly impact stock prices.

- Economic Indicators: Macroeconomic factors such as inflation and unemployment rates can influence market performance.

- Technological Advancements: Innovations and new products can lead to increased investor interest.

- Competition: The performance of competitors like Amazon and Microsoft can also sway Google's stock prices.

Competitor Analysis

An essential component of understanding Google stock is analyzing its competitors. Here’s how Google stacks up against its main rivals:

| Company | Market Capitalization | Revenue (2022) |

|---|---|---|

| Google (Alphabet Inc.) | $1.5 Trillion | $279 Billion |

| Amazon | $1.3 Trillion | $513 Billion |

| Microsoft | $2.5 Trillion | $198 Billion |

Google remains competitive in terms of market cap and revenue, but the tech landscape is continuously evolving.

Future Forecasts for Google Stock

Analysts have mixed predictions for Google stock in the upcoming years. Factors such as increasing competition, regulatory challenges, and economic conditions will play a crucial role. However, many experts remain optimistic about Google’s long-term growth potential based on its market leadership and innovative capabilities.

Investor Strategies for Google Stocks

For those looking to invest in Google stock, here are some strategies to consider:

- Diversify: Don’t put all your eggs in one basket. Consider a portfolio that includes various tech stocks.

- Stay Informed: Keep up with market trends and news to make informed decisions.

- Long-term Perspective: Focus on the long-term growth potential rather than short-term fluctuations.

Conclusion

In conclusion, the Google stock market is a vital area for investors to explore. With its historical performance, strong financial metrics, and potential for future growth, Google remains a compelling option. However, it’s essential to consider various factors influencing stock prices and market trends. We encourage you to stay informed and share your thoughts or questions in the comments below.

For more enriching articles and insights about the stock market, don’t forget to check out other sections on our site. Your journey into understanding the financial world continues here!

Jack Della Maddalena: The Rising Star In Mixed Martial Arts

Understanding INR To USD: A Comprehensive Guide

Torrentz: The Ultimate Guide To Understanding Torrenting And Its Impact