Understanding The GE Stock Chart: A Comprehensive Guide

The GE stock chart is a vital tool for investors looking to make informed decisions about their investments in General Electric Company. In this article, we will delve into the intricacies of the GE stock chart, exploring its historical performance, key indicators, and what it signifies for both current and potential investors. Understanding these elements can empower investors to navigate the complexities of the stock market more effectively.

General Electric (GE) has long been a significant player in various industries, from aviation to renewable energy. The company’s stock chart reflects its operational performance, market conditions, and broader economic trends. In this guide, we will break down the components of the GE stock chart, analyze its trends, and provide insights into how to interpret the data for better investment decisions.

As we explore the GE stock chart, we will cover essential concepts and tools such as moving averages, volume analysis, and technical indicators. This comprehensive analysis aims to equip you with the knowledge and skills necessary to read and interpret stock charts, particularly for GE. Whether you are a seasoned investor or a novice, this article will serve as a valuable resource in your investment journey.

Table of Contents

- 1. What is a Stock Chart?

- 2. Overview of General Electric Company

- 3. Historical Performance of GE Stock

- 4. Key Components of the GE Stock Chart

- 5. Analyzing GE Stock Trends

- 6. Technical Indicators in GE Stock Analysis

- 7. Future Outlook for GE Stock

- 8. Conclusion

1. What is a Stock Chart?

A stock chart is a graphical representation of a stock's price movements over a specific period. These charts are essential tools for investors, providing insights into price trends, trading volume, and market sentiment. By analyzing stock charts, investors can identify patterns that may indicate future price movements.

2. Overview of General Electric Company

General Electric Company, founded in 1892, has evolved into one of the most diversified industrial companies in the world. GE operates in various sectors, including aviation, power, renewable energy, and healthcare. This broad portfolio makes GE a significant presence in the stock market.

2.1 GE Company Profile

| Attribute | Details |

|---|---|

| Founded | 1892 |

| Headquarters | Boston, Massachusetts, USA |

| CEO | H. Lawrence Culp, Jr. |

| Market Cap | Approximately $120 billion (as of October 2023) |

3. Historical Performance of GE Stock

The historical performance of GE stock provides valuable insights into its trends and volatility. Over the years, GE has experienced significant highs and lows, influenced by various factors, including economic conditions, industry trends, and company performance.

3.1 Stock Price Trends

Analyzing the historical stock prices can reveal patterns that may indicate future performance. For instance, from 2000 to 2016, GE stock saw a steady decline due to various challenges, including financial performance and market competition. However, in recent years, GE has implemented strategic changes that have positively impacted its stock price.

4. Key Components of the GE Stock Chart

Understanding the key components of a stock chart is essential for effective analysis. The GE stock chart includes various elements such as price movements, volume, and moving averages.

4.1 Price Movements

Price movements indicate how the stock's value has changed over time. Investors often look for patterns such as uptrends, downtrends, and consolidation phases. These movements can provide insights into market sentiment and potential future price actions.

4.2 Trading Volume

Volume measures the number of shares traded during a specific period. High trading volume can indicate strong investor interest, while low volume may suggest a lack of interest. Analyzing volume alongside price movements can help identify potential reversals or continuations in trends.

5. Analyzing GE Stock Trends

Trend analysis is crucial for understanding the overall direction of GE stock. Investors often use various methods to analyze trends, including moving averages and trendlines.

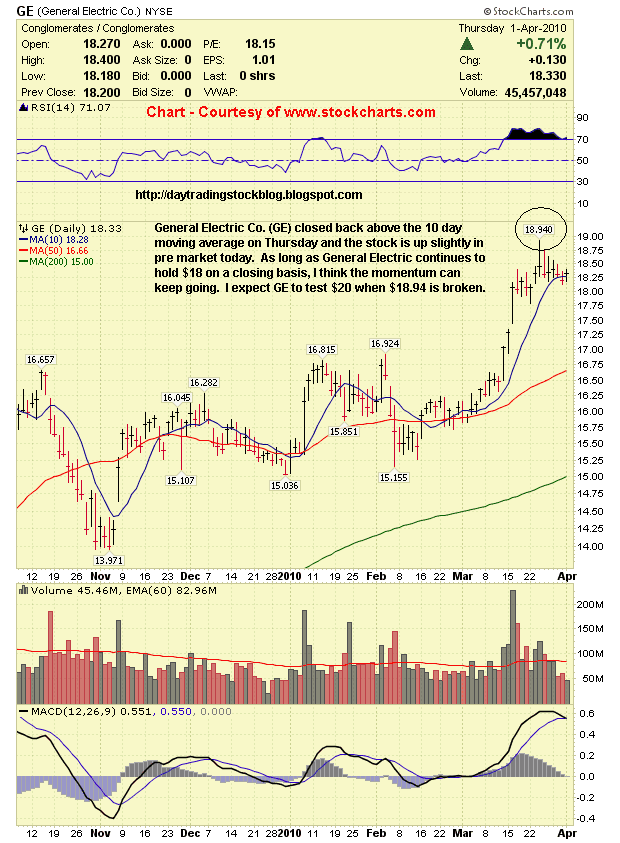

5.1 Moving Averages

Moving averages smooth out price data to identify trends over time. Commonly used moving averages include the 50-day and 200-day moving averages. When the stock price crosses above these averages, it may indicate a bullish trend, while a crossover below may signal a bearish trend.

5.2 Trendlines

Trendlines are straight lines drawn on a chart that connect significant price points. They help visualize the overall direction of the stock and can indicate potential support and resistance levels.

6. Technical Indicators in GE Stock Analysis

Technical indicators are mathematical calculations based on price and volume data that help investors analyze market trends. Some popular indicators include the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD).

6.1 Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. Values above 70 indicate that a stock is overbought, while values below 30 suggest it is oversold. Monitoring the RSI can help investors identify potential reversal points.

6.2 Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a stock's price. It consists of the MACD line, signal line, and histogram. Crossovers of these lines can signal potential buy or sell opportunities.

7. Future Outlook for GE Stock

The future outlook for GE stock depends on various factors, including the company's strategic initiatives, market conditions, and economic indicators. Investors should stay informed about the company's performance and industry trends to make informed investment decisions.

7.1 Market Conditions

Market conditions, such as interest rates, inflation, and economic growth, play a crucial role in the performance of GE stock. Monitoring these factors can help investors anticipate potential price movements.

7.2 Company Initiatives

GE's strategic initiatives, such as investments in renewable energy and technology advancements, can significantly impact its stock performance. Understanding these initiatives can provide insights into the company's future growth potential.

8. Conclusion

In conclusion, the GE stock chart is a powerful tool for investors seeking to understand the historical performance and future potential of General Electric Company. By analyzing price movements, trading volume, and utilizing technical indicators, investors can make more informed decisions. As always, it is essential to conduct thorough research and stay updated on market trends to navigate the complexities of stock investing successfully.

We encourage you to leave your comments and insights below, share this article with fellow investors, and explore more articles on our site for additional investment guidance.

Thank you for reading, and we look forward to seeing you again for more in-depth financial analyses and investment tips!

Doug McDermott: The Journey Of A Basketball Star

Understanding Waddle: The Fascinating World Of Animal Movement

Understanding Stocks In S&P 500: A Comprehensive Guide