Dodge And Cox Stock Fund Price: A Comprehensive Guide

The Dodge and Cox Stock Fund price is a topic of great interest for both seasoned investors and those new to the world of mutual funds. Understanding its performance, management, and overall market trends can significantly influence your investment decisions. In this article, we will delve deep into the performance of the Dodge and Cox Stock Fund, exploring its historical data, management strategies, and how it aligns with current market conditions.

Investors are constantly seeking funds that offer a balance of risk and return. The Dodge and Cox Stock Fund has been a popular choice for many due to its long-standing reputation and consistent performance. This article will provide insights into the fund’s price movements, key holdings, and overall market positioning, helping you make an informed decision.

As we navigate through the details of the Dodge and Cox Stock Fund, we'll provide you with comprehensive data and statistics, ensuring that you have all the essential information at your fingertips. Whether you're considering investing or already have a stake in the fund, this guide aims to equip you with the knowledge needed to understand its dynamics better.

Table of Contents

- Biography of Dodge and Cox

- Key Data and Statistics

- Performance Overview

- Management Strategy

- Investment Philosophy

- Market Trends Analysis

- Risks Involved

- Conclusion

Biography of Dodge and Cox

Dodge and Cox is a respected investment management firm founded in 1930. The firm is known for its value-oriented investment philosophy and a commitment to long-term performance. Over the decades, it has built a solid reputation among investors for its disciplined approach to equity investing.

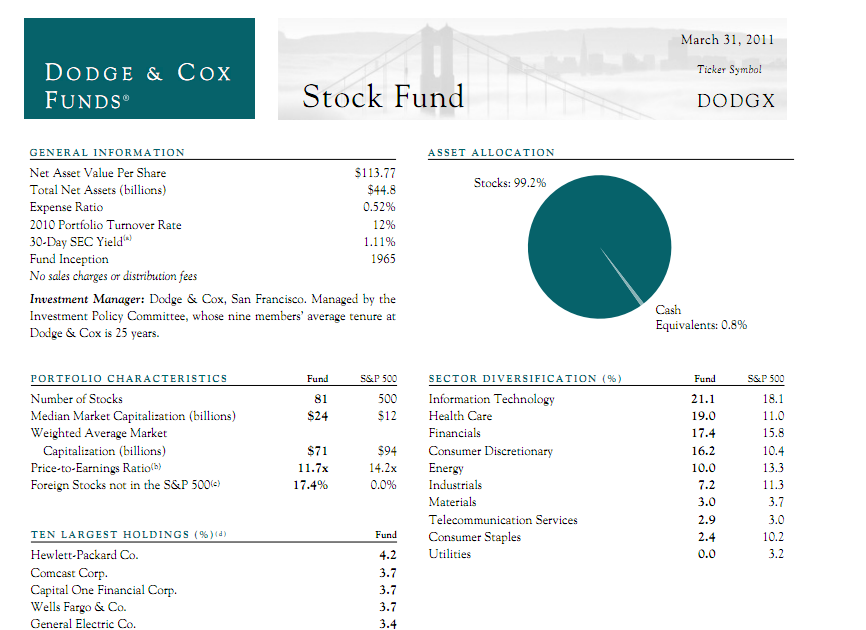

The firm's flagship fund, the Dodge and Cox Stock Fund, was launched in 1965 and has consistently ranked among the top performers in its category. With a team of experienced professionals, Dodge and Cox focuses on thorough research and analysis to identify undervalued stocks with strong growth potential.

Key Personal Information

| Founding Year | 1930 |

|---|---|

| Flagship Fund Launch Year | 1965 |

| Headquarters | San Francisco, California |

| Investment Philosophy | Value Investing |

Key Data and Statistics

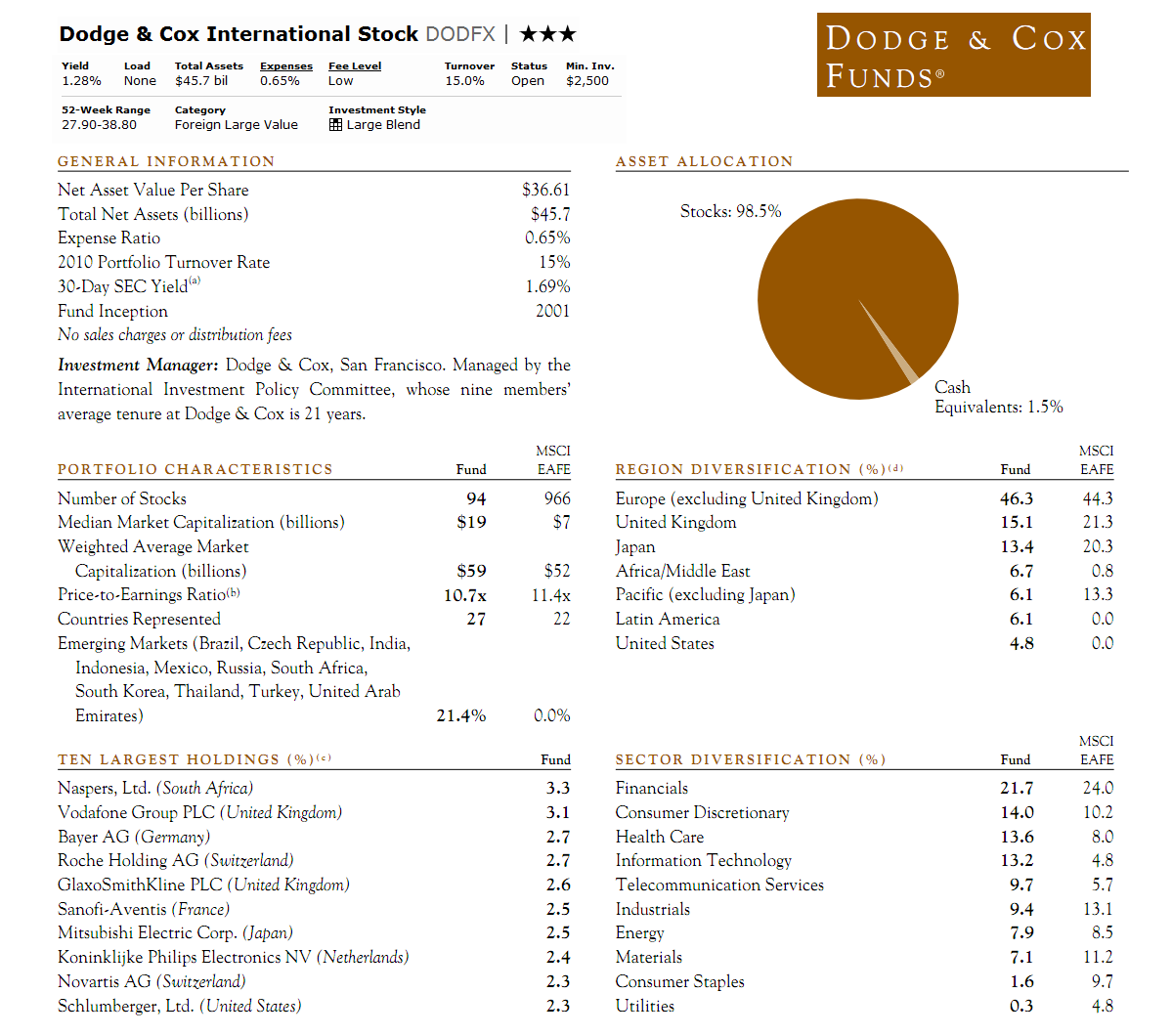

Understanding the key data and statistics surrounding the Dodge and Cox Stock Fund is crucial for potential investors. Here are some essential figures:

- Net Asset Value (NAV): The fund's NAV is updated daily and reflects the value of all assets held in the fund.

- Expense Ratio: The Dodge and Cox Stock Fund boasts a competitive expense ratio compared to its peers, making it an appealing option for cost-conscious investors.

- Dividend Yield: The fund typically has a healthy dividend yield, providing investors with regular income in addition to capital appreciation.

- Top Holdings: The fund's top holdings often include large-cap companies across various sectors, reflecting its diversified investment strategy.

Performance Overview

When evaluating the performance of the Dodge and Cox Stock Fund, it is essential to consider both short-term and long-term results. Historically, the fund has outperformed its benchmark, the S&P 500, over various time frames.

Some key performance metrics include:

- 1-Year Return: The fund's return over the last year compared to the S&P 500.

- 5-Year Return: An analysis of the fund's performance over the past five years.

- 10-Year Return: Long-term performance, showcasing the fund's resilience and ability to weather market fluctuations.

Management Strategy

The management strategy employed by Dodge and Cox is centered around rigorous research and fundamental analysis. The investment team conducts extensive evaluations of potential investments, focusing on the following aspects:

- Valuation: Identifying stocks that are undervalued relative to their intrinsic worth.

- Quality: Investing in companies with strong fundamentals and competitive advantages.

- Management: Assessing the quality and track record of a company's management team.

Investment Process

The investment process at Dodge and Cox includes a comprehensive review of financial statements, market trends, and macroeconomic factors that may influence stock performance.

Investment Philosophy

The investment philosophy guiding Dodge and Cox centers on the belief that long-term investment success is achieved through a disciplined approach based on value investing. Key tenets of their philosophy include:

- Long-Term Focus: The team emphasizes holding investments for the long term, allowing time for the market to recognize and correct mispricings.

- Diverse Portfolio: The fund maintains a diversified portfolio across sectors and industries, reducing risk and enhancing potential returns.

- Active Management: The investment team actively manages the portfolio, making adjustments based on thorough analysis and market conditions.

Market Trends Analysis

To understand the performance of the Dodge and Cox Stock Fund, it's essential to analyze current market trends. Factors such as economic growth, interest rates, and geopolitical events can significantly impact stock prices.

In recent years, the market has experienced volatility due to various factors, including:

- Economic Recovery: Post-pandemic recovery has influenced growth sectors, creating opportunities for value investments.

- Inflation Rates: Rising inflation rates have prompted discussions about interest rate adjustments and their effects on the stock market.

- Technological Advancements: Companies that adapt to technological changes often outperform their peers, impacting fund performance.

Risks Involved

Like any investment, the Dodge and Cox Stock Fund is not without risks. Potential investors should be aware of the following:

- Market Risk: The fund's performance is subject to market fluctuations, which can affect stock prices.

- Sector Risk: Concentration in specific sectors may expose the fund to higher volatility if those sectors underperform.

- Management Risk: The success of the fund is heavily dependent on the investment team's decisions and strategies.

Conclusion

In conclusion, the Dodge and Cox Stock Fund price is influenced by a variety of factors, including market conditions, management strategies, and overall economic trends. As a potential investor, understanding the fund's historical performance, key data, and risks involved is essential for making informed investment decisions.

We encourage you to further explore the Dodge and Cox Stock Fund, review its performance, and consider how it aligns with your investment goals. Feel free to leave a comment below or share this article with fellow investors who may find it helpful.

Thank you for reading, and we invite you to return for more insights on investment strategies and financial markets.

Understanding Live Oak Bank: A Comprehensive Guide

Ansel: The Rising Star Of Hollywood

Who Is On The $2 Bill? Unveiling The History And Significance