Apy Vs Apr: Understanding The Differences And Their Impact On Your Finances

In the world of finance, understanding the difference between APY and APR is crucial for making informed decisions. These two terms are often used interchangeably, but they represent different concepts that can significantly impact your savings and borrowing strategies. In this comprehensive guide, we will delve into the definitions, calculations, and implications of APY (Annual Percentage Yield) and APR (Annual Percentage Rate) to help you navigate your financial landscape effectively.

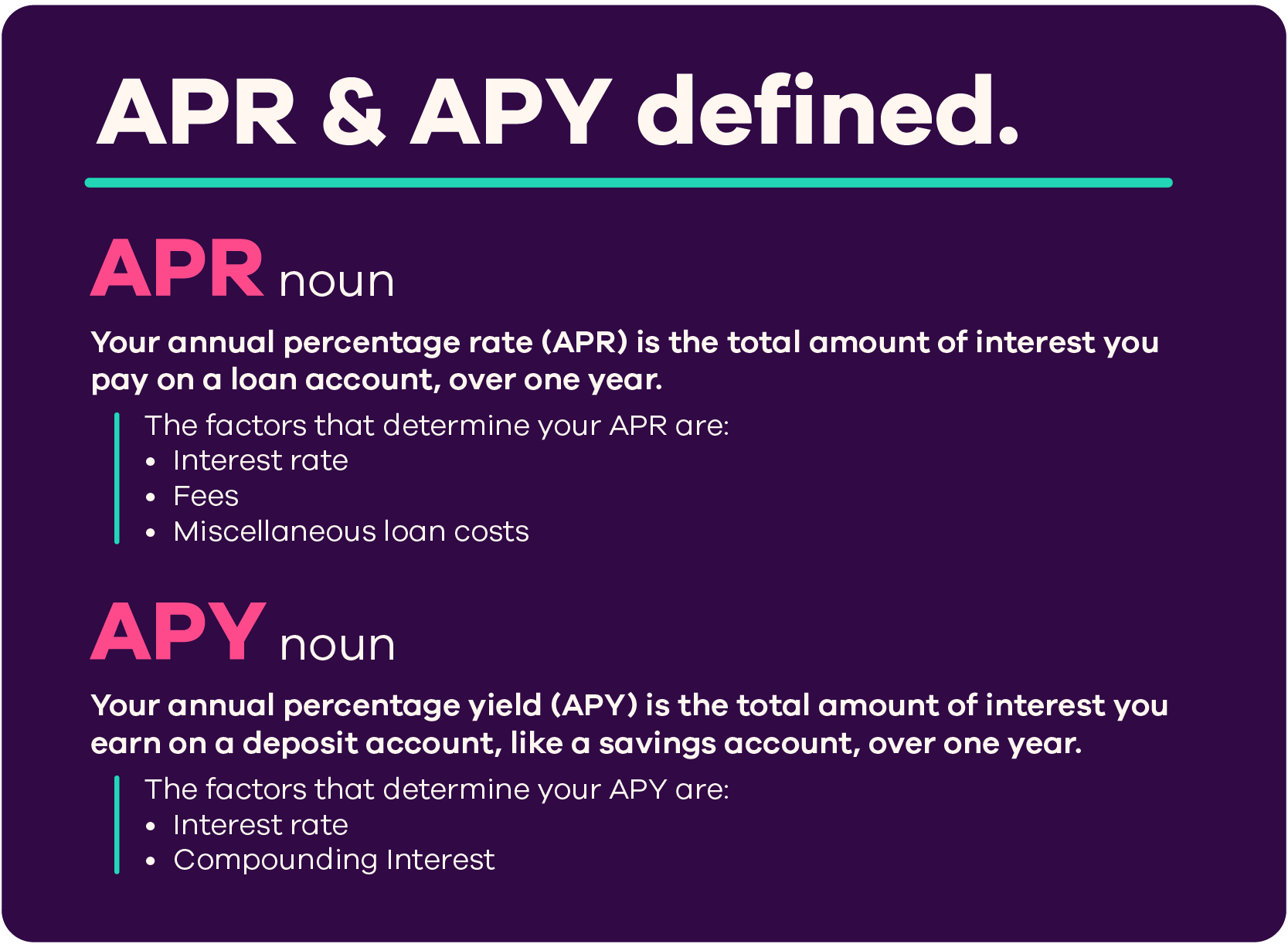

First, let’s clarify what APY and APR mean. APY refers to the rate of return on your investments or savings, taking into account the effect of compounding interest. On the other hand, APR is the annual rate charged for borrowing or earned through an investment, not accounting for compounding. Understanding these distinctions will help you evaluate loans, credit cards, and savings accounts more effectively.

This article will cover everything you need to know about APY and APR, including their calculations, advantages, disadvantages, and practical applications. By the end, you will have a solid understanding of how these rates influence your financial decisions, helping you to maximize your earnings and minimize your borrowing costs.

Table of Contents

- 1. Definition of APY and APR

- 2. How APY and APR are Calculated

- 3. The Impact of APY and APR on Savings

- 4. The Role of APY and APR in Loans

- 5. Advantages of Understanding APY and APR

- 6. Disadvantages of APY and APR

- 7. Common Questions about APY and APR

- 8. Conclusion and Final Thoughts

1. Definition of APY and APR

APY, or Annual Percentage Yield, measures the total amount of interest earned on an investment or savings account over a year, including the effects of compounding. It provides a more accurate representation of an investment's potential return, making it essential for comparing different savings accounts or investment vehicles.

APR, or Annual Percentage Rate, represents the annual cost of borrowing money, expressed as a percentage of the loan amount. It includes interest and any additional fees related to the loan but does not account for compounding, making it a simpler measure of borrowing costs.

2. How APY and APR are Calculated

Calculating APY

To calculate APY, you can use the following formula:

APY = (1 + r/n)^(n*t) - 1

Where:

- r = nominal interest rate (as a decimal)

- n = number of compounding periods per year

- t = time in years

Calculating APR

To calculate APR, the formula is simpler:

APR = (Interest + Fees) / Principal Amount

Then, multiply by the number of periods in a year.

3. The Impact of APY and APR on Savings

The choice between APY and APR can significantly influence your savings strategy. When evaluating savings accounts, you should prioritize accounts with higher APY, as they will yield more interest over time. Conversely, when considering loans, focus on the APR, as a lower APR will reduce your overall borrowing costs.

- Higher APY = More earnings on savings

- Lower APR = Cheaper loans

4. The Role of APY and APR in Loans

When taking out a loan, understanding the APR is essential. Lenders are required to disclose the APR, allowing borrowers to compare different loan offers effectively. A loan with a lower APR will cost you less in interest, making it crucial to evaluate loans based on this rate.

5. Advantages of Understanding APY and APR

Understanding APY and APR offers several benefits:

- Better financial decision-making when choosing savings accounts and loans.

- Ability to compare different financial products effectively.

- Enhanced awareness of how compounding affects your investments.

6. Disadvantages of APY and APR

While understanding APY and APR is beneficial, there are disadvantages:

- Potential confusion between the two terms can lead to poor financial choices.

- APY may not be applicable for all types of investments, particularly those without compounding interest.

7. Common Questions about APY and APR

Here are some frequently asked questions regarding APY and APR:

What is the difference between APY and APR?

APY accounts for compounding interest, while APR does not. APY is used for savings accounts, and APR is used for loans.

How does compounding affect APY?

Compounding increases the total interest earned on an investment over time, making APY a more favorable measure for savings accounts.

8. Conclusion and Final Thoughts

In conclusion, understanding the differences between APY and APR is vital for making informed financial decisions. By focusing on APY for savings and APR for loans, you can maximize your earnings and minimize your costs. Always compare financial products based on these metrics to ensure you are making the best choice for your financial future.

If you found this article helpful, please leave a comment below, share it with your friends, and explore our other articles for more financial insights!

Thank you for reading, and we hope to see you again soon!

Understanding The Euro To Dollar Exchange Rate: Trends, Factors, And Future Predictions

Latest Developments In Wells Fargo News: What You Need To Know

Understanding 2nd Base Means: A Comprehensive Guide

:max_bytes(150000):strip_icc()/Apr-apy-bank-hopes-cant-tell-difference_final-15cefe4dc77a4d81a02be1e2a26a4fac.png)