Understanding ZG Stock: A Comprehensive Guide For Investors

ZG stock has become a focal point for investors looking to capitalize on the dynamic real estate market. As the demand for housing and commercial properties continues to rise, understanding the intricacies of ZG stock is crucial for making informed investment decisions. In this article, we will delve deep into the various aspects of ZG stock, including its background, market performance, and future potential.

The landscape of real estate investment has evolved dramatically over the years, and ZG stock stands at the forefront of this transformation. By exploring the fundamentals of ZG stock, its historical performance, and the factors influencing its price movements, investors can gain valuable insights into how to leverage this asset for their portfolios. This comprehensive guide aims to equip you with the knowledge necessary to navigate the complexities of ZG stock.

Whether you are a seasoned investor or new to the stock market, understanding ZG stock will provide you with the tools to make strategic investment choices. Join us as we explore the essential elements that define ZG stock and what potential investors should consider before making their move.

Table of Contents

- 1. What is ZG Stock?

- 2. Historical Performance of ZG Stock

- 3. Factors Influencing ZG Stock Price

- 4. Biographical Overview of ZG Stock

- 5. Analyzing Market Trends

- 6. Investment Strategies for ZG Stock

- 7. Risks Associated with ZG Stock

- 8. Future Outlook for ZG Stock

1. What is ZG Stock?

ZG stock refers to the shares of Zillow Group, Inc., a company that operates an online real estate marketplace. Founded in 2006, Zillow has transformed the way people buy, sell, and rent properties. The company provides a platform for users to access real estate listings, estimate home values (Zestimate), and connect with real estate professionals.

1.1 Overview of Zillow Group

Zillow Group is headquartered in Seattle, Washington, and operates several brands, including Zillow, Trulia, and StreetEasy. The company's mission is to empower consumers with data and information to make informed real estate decisions.

1.2 Importance of ZG Stock in the Market

As a publicly traded company, ZG stock is an essential component of the real estate sector. Investors look to ZG stock for exposure to the growing real estate market and the potential for long-term capital appreciation.

2. Historical Performance of ZG Stock

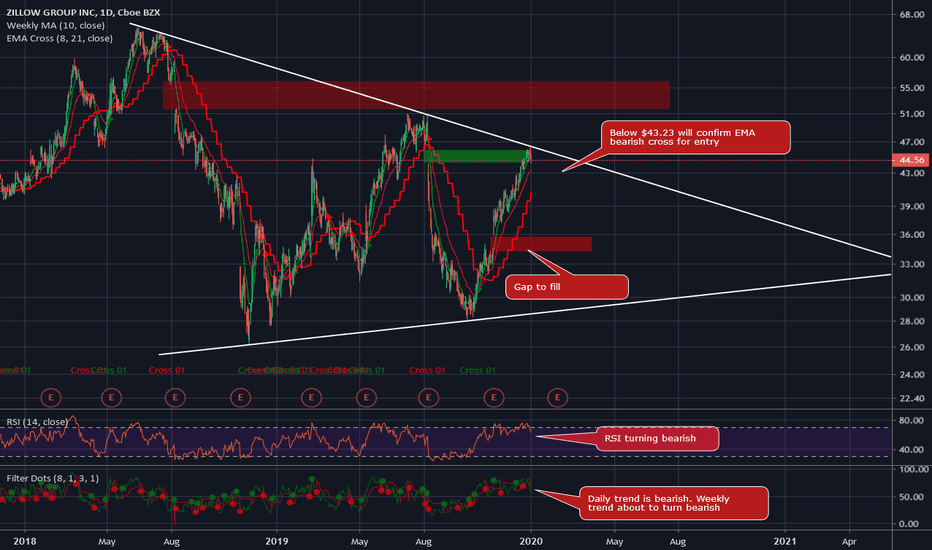

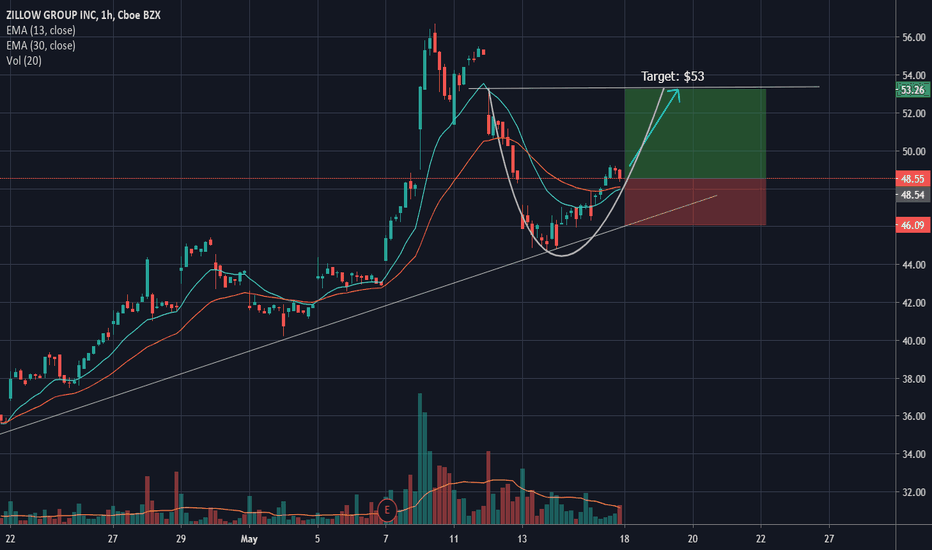

To understand the potential of ZG stock, it's essential to analyze its historical performance. Since its IPO in 2011, ZG stock has experienced significant volatility, reflecting broader market trends and company-specific developments.

2.1 Stock Price Trends Over the Years

ZG stock has seen substantial growth, particularly during periods of increased housing demand. However, it has also faced challenges, including market corrections and shifts in consumer behavior.

2.2 Key Milestones in ZG Stock History

- 2011: Zillow goes public at $20 per share.

- 2018: ZG stock reaches an all-time high of $66 per share.

- 2020: Market volatility due to the COVID-19 pandemic impacts ZG stock performance.

3. Factors Influencing ZG Stock Price

The price of ZG stock is influenced by several factors, including market conditions, economic indicators, and company performance. Understanding these factors is crucial for investors looking to make informed decisions.

3.1 Economic Indicators

Key economic indicators such as interest rates, unemployment rates, and housing market trends significantly impact ZG stock. For instance, lower interest rates often lead to increased housing demand, positively affecting Zillow's business model.

3.2 Competitive Landscape

The real estate market is highly competitive, with numerous online platforms vying for market share. Zillow's ability to innovate and maintain its competitive edge directly influences ZG stock performance.

4. Biographical Overview of ZG Stock

ZG stock's journey is intertwined with Zillow Group's growth as a leading real estate platform. Understanding the company's background is essential for investors.

4.1 Company Founders and Leadership

Zillow was co-founded by Rich Barton and Lloyd Frink, both former Microsoft executives. Their vision for creating a user-friendly real estate platform has propelled Zillow's success.

4.2 Key Data and Company Facts

| Fact | Detail |

|---|---|

| Founded | 2006 |

| Headquarters | Seattle, Washington |

| CEO | Rich Barton |

| Stock Symbol | ZG |

5. Analyzing Market Trends

Market trends play a crucial role in determining the future potential of ZG stock. Investors must stay informed about current trends to make strategic decisions.

5.1 Current Market Conditions

The real estate market has seen a surge in demand, driven by low mortgage rates and changing consumer preferences. These factors create a favorable environment for ZG stock.

5.2 Future Trends to Watch

- Technological advancements in real estate.

- Increased focus on sustainability and eco-friendly homes.

- Shifts in consumer demographics and preferences.

6. Investment Strategies for ZG Stock

For investors looking to capitalize on ZG stock, developing a solid investment strategy is essential. Here are some approaches to consider:

6.1 Long-Term Investment

Investing in ZG stock for the long term can be beneficial, especially if the real estate market continues to grow. Holding onto shares during market fluctuations may lead to significant gains over time.

6.2 Diversification

Including ZG stock as part of a diversified portfolio can help mitigate risks associated with market volatility. Consider balancing investments across different sectors.

7. Risks Associated with ZG Stock

Like any investment, ZG stock carries inherent risks that investors must consider before making any decisions.

7.1 Market Volatility

The real estate market can be unpredictable, and ZG stock may experience significant price fluctuations. Investors should be prepared for potential downturns.

7.2 Regulatory Risks

Changes in regulations affecting the real estate industry can impact Zillow's operations and, consequently, ZG stock performance.

8. Future Outlook for ZG Stock

The future of ZG stock appears promising, driven by the ongoing demand for real estate services and innovation within the company. As Zillow continues to evolve, investors may find new opportunities for growth.

8.1 Analyst Predictions

Several analysts have provided optimistic forecasts for ZG stock, citing the company's strong market position and potential for continued growth.

8.2 Conclusion on ZG Stock's Potential

While there are risks involved, the potential rewards of investing in ZG stock make it an attractive option for many investors.

Conclusion

In summary, ZG stock represents a compelling investment opportunity within the real estate market. By understanding its historical performance, market trends, and potential risks, investors can make informed decisions. As you consider your investment strategy, take the time to analyze your options and stay updated on market developments.

We invite you to share your thoughts on ZG stock in the comments below and encourage you to explore other articles on our site for more investment insights.

Penutup

Thank you for reading our comprehensive guide on ZG stock. We hope you found the information valuable and that it inspires you to delve deeper into the world of real estate investments. We look forward to seeing you again on our site!

Jim Jones: The Rise And Legacy Of A Hip-Hop Icon

Understanding Beef Bacon: A Delicious Alternative For Meat Lovers

Quiet Place Day One: After Credits Explained