Understanding Stock Splits: What To Expect In 2024

As the financial landscape continues to evolve, stock splits are becoming an increasingly relevant topic for investors in 2024. This article will delve into the intricacies of stock splits, including their implications, historical data, and expert insights. Understanding stock splits can provide investors with a competitive edge in making informed decisions in the stock market.

In this comprehensive guide, we will explore what stock splits are, their types, and why companies choose to execute them. Additionally, we will examine the anticipated stock splits for 2024 and the potential impact they may have on the market and individual investors. By the end of this article, you will have a thorough understanding of stock splits and how they can affect your investment strategies.

Whether you are a seasoned investor or just starting, this article aims to equip you with the knowledge necessary to navigate the world of stock splits effectively. Let’s dive into the details and discover everything you need to know about stock splits in 2024.

Table of Contents

- What Are Stock Splits?

- Types of Stock Splits

- Why Do Companies Split Their Stocks?

- Historical Data on Stock Splits

- Anticipated Stock Splits in 2024

- Impact of Stock Splits on Investors

- Expert Insights on Stock Splits

- Conclusion

What Are Stock Splits?

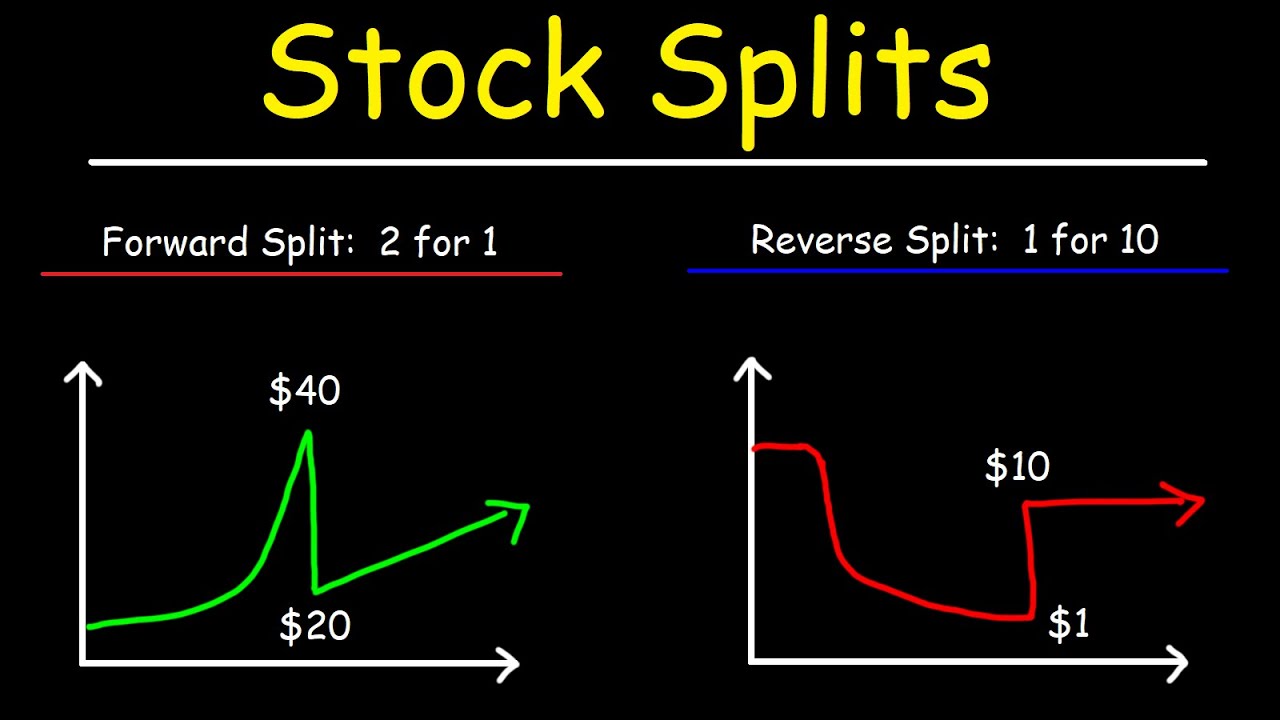

A stock split is a corporate action in which a company divides its existing shares into multiple new shares. This increase in the number of shares reduces the price of each share, making them more affordable for investors. For instance, in a 2-for-1 stock split, every shareholder will receive an additional share for each share they own, effectively halving the stock price.

Stock splits do not affect the overall market capitalization of the company. Before and after the split, the total value of an investor's holdings remains unchanged. The primary goal of a stock split is to enhance liquidity and attract a broader base of investors.

Types of Stock Splits

There are several types of stock splits that companies can implement, including:

- Forward Stock Split: This is the most common type, where a company increases the number of shares outstanding, resulting in a lower price per share.

- Reverse Stock Split: In this scenario, a company consolidates its shares, reducing the number of shares outstanding and increasing the price per share. This is often done to meet minimum stock price requirements.

- Stock Dividend: While not a traditional split, companies may issue stock dividends, providing shareholders with additional shares based on the number of shares they already own.

Why Do Companies Split Their Stocks?

Companies may choose to split their stocks for various reasons, including:

- Increase Liquidity: Lower share prices can attract more investors, thereby increasing trading volume.

- Make Shares More Affordable: A lower price per share can make the stock more accessible to retail investors.

- Attract Institutional Investors: Some institutional investors have policies that prevent them from buying stocks above a certain price.

- Positive Market Sentiment: A stock split may signal to the market that the company is performing well, which can boost investor confidence.

Historical Data on Stock Splits

Examining historical data on stock splits can provide valuable insights into market trends and investor behavior. Historically, stocks that undergo splits tend to perform well in the short term. For example:

- According to a study by the University of Chicago, stocks that had split in the previous three years outperformed the market by an average of 8%.

- Companies such as Apple and Amazon have executed multiple stock splits, leading to significant gains in their stock prices post-split.

This historical performance suggests that stock splits can be a positive signal for investors, although past performance is not indicative of future results.

Anticipated Stock Splits in 2024

As we look forward to 2024, several companies are expected to announce stock splits. While predictions can vary, some of the companies on analysts' radar include:

- Alphabet Inc. (GOOGL): Given its consistently high stock price, many analysts speculate that Alphabet may execute a stock split in 2024.

- Tesla Inc. (TSLA): After previous splits, Tesla's stock remains a focus for potential splits to enhance accessibility.

- Nvidia Corp. (NVDA): Nvidia has seen significant growth, leading to speculation about a possible split to boost liquidity.

Investors should stay informed about these announcements, as they can impact stock performance significantly.

Impact of Stock Splits on Investors

The impact of stock splits on investors can be both psychological and financial. Here are some key points to consider:

- Psychological Impact: Lower stock prices can create a perception of affordability, encouraging more investors to buy.

- Potential for Increased Volatility: Increased trading volume post-split can lead to higher volatility, affecting short-term investors.

- Long-Term Investment Strategy: Investors should focus on the company's fundamentals rather than short-term price movements.

Expert Insights on Stock Splits

Experts in the field of finance offer valuable insights regarding stock splits:

- Market Analyst John Doe: “Stock splits can be a strategic move for companies looking to enhance their market presence and liquidity.”

- Investment Advisor Jane Smith: “Investors should view stock splits as an opportunity to reassess their investment strategies and consider the long-term potential.”

By heeding expert advice, investors can make informed decisions regarding stock splits and their implications.

Conclusion

In conclusion, stock splits are significant corporate actions that can influence both market dynamics and investor behavior. As we anticipate stock splits in 2024, understanding their implications is crucial for investors at all levels. Whether you’re looking to buy, hold, or sell stocks, being informed about these events can enhance your investment strategy.

We encourage you to engage with this topic further by leaving comments, sharing this article, or exploring additional resources on stock market trends.

Thank you for reading! We hope to see you back for more insights and updates on the financial world.

Understanding AMAT: The Importance Of Advanced Materials And Technologies

Cheap Stocks To Buy Today: A Comprehensive Guide For Savvy Investors

Understanding Devante Parker: The Rising Star Of American Football