The Comprehensive Guide To NYSE: AXP - American Express Company

American Express Company, commonly referred to by its stock ticker NYSE: AXP, is a powerhouse in the financial services industry. Founded in 1850, this company has evolved from its origins as an express mail service into a global leader in payment solutions. With a focus on premium customer service and an extensive range of financial products, American Express has built a reputation that resonates with reliability and excellence.

In this article, we will delve into the various aspects of American Express, including its history, financial performance, and market position. We will also explore the key factors that influence its stock, making it a vital subject for investors and financial enthusiasts alike. Understanding AXP is crucial for anyone looking to navigate the complexities of the stock market, especially in the financial sector.

As we journey through the details of NYSE: AXP, this comprehensive guide aims to provide insights that are not only informative but also actionable for potential investors. By the end of this article, readers will gain a holistic view of American Express and its role in the financial ecosystem.

Table of Contents

- 1. The History of American Express

- 2. Financial Performance of NYSE: AXP

- 3. Products and Services Offered

- 4. Market Position and Competition

- 5. Stock Performance and Trends

- 6. Investing in NYSE: AXP

- 7. Future Outlook for American Express

- 8. Conclusion

1. The History of American Express

American Express was founded in 1850 as an express mail business in Buffalo, New York. Over the decades, the company diversified its offerings, but it wasn't until the introduction of the charge card in 1950 that American Express started to carve out its niche in the financial services sector. The iconic green card quickly became a status symbol, illustrating the brand's commitment to providing premium services.

In 1966, American Express launched its first credit card, further solidifying its role in the payment industry. The company continued to innovate, introducing the Membership Rewards program in 1991, which set the standard for customer loyalty programs.

Today, American Express is not just a card issuer but also a global payment network, serving millions of customers and merchants worldwide. Its history illustrates a company that adapts and evolves with changing market dynamics while maintaining its core values of customer service and trust.

2. Financial Performance of NYSE: AXP

American Express has consistently demonstrated strong financial performance, making it an attractive option for investors. The company reports its financials quarterly, and key metrics such as revenue, net income, and earnings per share (EPS) are closely monitored by analysts.

Key Financial Metrics:

- Revenue: In 2022, American Express reported revenue of $52.86 billion, a significant increase from previous years.

- Net Income: The net income for 2022 was approximately $6.84 billion, showcasing the company's profitability.

- EPS: The diluted earnings per share for 2022 were $8.09, reflecting robust growth.

These financial indicators not only reflect American Express's operational efficiency but also its ability to navigate economic challenges effectively. The company's focus on premium customers and businesses has allowed it to maintain a healthy profit margin.

3. Products and Services Offered

American Express offers a wide array of products and services tailored to meet the diverse needs of its customers. These include:

3.1 Charge and Credit Cards

American Express is renowned for its charge and credit cards. The most popular products include:

- The American Express Gold Card

- The Platinum Card

- The Blue Cash Preferred Card

3.2 Travel Services

American Express also provides extensive travel services, including:

- Travel booking and planning

- Luxury travel experiences

- Travel insurance

3.3 Business Solutions

For businesses, American Express offers solutions such as:

- Corporate credit cards

- Expense management tools

- Business loans and financing options

4. Market Position and Competition

American Express holds a unique position in the financial services market due to its focus on affluent customers. Unlike its competitors, such as Visa and Mastercard, which primarily focus on volume, American Express emphasizes value-added services and customer relationships.

Key Competitors:

- Visa Inc.

- Mastercard Inc.

- Discover Financial Services

American Express's business model allows it to command higher fees from merchants, which contributes to its profitability. The company's strong brand loyalty also helps it retain customers in a competitive landscape.

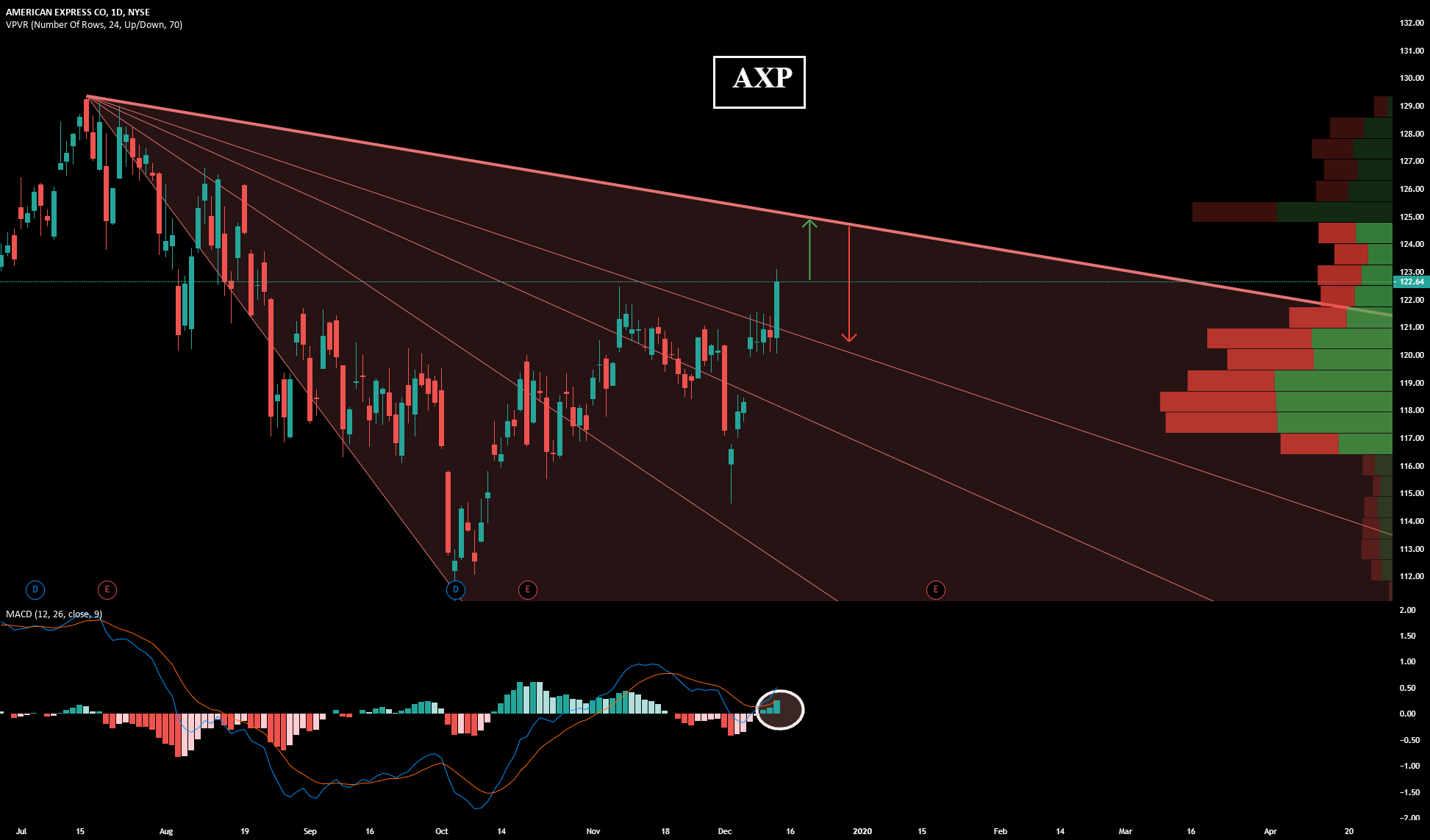

5. Stock Performance and Trends

Investors closely watch the performance of AXP on the New York Stock Exchange. Historically, the stock has shown resilience and growth potential. Factors influencing stock price include:

- Financial performance reports

- Market conditions

- Economic indicators

As of October 2023, the stock price of AXP is around $174.65, reflecting a year-to-date increase of approximately 10%. Analysts suggest that the stock has room for growth due to the company's ongoing initiatives and strong market position.

6. Investing in NYSE: AXP

For investors looking to add AXP to their portfolio, several factors should be considered:

- Long-term growth potential

- Dividend yield (currently around 1.3%)

- Overall market trends and economic forecasts

It's advisable for investors to conduct thorough research and possibly consult financial advisors to align their investment strategies with their financial goals.

7. Future Outlook for American Express

The future of American Express looks promising, driven by its commitment to innovation and customer service. With the rise of digital payments and fintech, American Express is adapting its services to meet evolving consumer preferences. The company is investing in technology to enhance user experience and streamline operations.

Market analysts predict continued growth for AXP, especially as more consumers seek premium services and loyalty programs. American Express’s focus on sustainable growth and customer satisfaction positions it well for future success.

8. Conclusion

In summary, American Express Company (NYSE: AXP) stands as a formidable entity in the financial services sector. Its history, robust financial performance, diverse product offerings, and unique market position contribute to its appeal for investors. As the company continues to innovate and adapt, it remains a strong contender in the competitive landscape.

For those interested in investing in American Express, understanding the various aspects discussed in this article will provide a solid foundation. We encourage readers to share their thoughts and engage with us in the comments section below. Don’t forget to explore our other articles for more insights!

Thank you for reading, and we hope to see you back on our site for more informative content!

Abducted In Plain Sight: A Deep Dive Into The Shocking True Story

Understanding Yahoo: A Comprehensive Guide

Exploring The Life And Legacy Of Clayton Moore: The Lone Ranger