Understanding Lyft Stock Price: Trends, Analysis, And Future Outlook

The Lyft stock price has been a topic of interest among investors and market analysts since the company's initial public offering (IPO) in 2019. With the rise of ride-sharing services, Lyft has positioned itself as a key player in the transportation industry. This article delves deep into the factors influencing Lyft's stock price, its historical performance, and potential future trends. By understanding these elements, investors can make informed decisions regarding their investments in Lyft.

Throughout this comprehensive guide, we will explore various aspects of Lyft's stock, including its current market position, financial health, competition, and strategic initiatives. We will also discuss the broader economic factors that may impact Lyft's stock price. Additionally, readers will find valuable insights through data analysis and expert opinions, ensuring a well-rounded understanding of the subject. Let's embark on this journey to unravel the complexities of Lyft's stock price and its implications for investors.

As we navigate through this analysis, we will also provide practical tips for potential investors and highlight the importance of staying informed about market changes. Whether you are a seasoned investor or just starting, this article aims to equip you with the knowledge needed to assess Lyft's stock performance effectively.

Table of Contents

- 1. Lyft Stock Price Overview

- 2. Historical Stock Performance

- 3. Financial Analysis

- 4. Market Competition

- 5. Economic Factors Influencing Lyft

- 6. Strategic Initiatives by Lyft

- 7. Future Outlook for Lyft Stock

- 8. Conclusion

1. Lyft Stock Price Overview

Lyft, Inc. is a prominent player in the ride-sharing market, and its stock is publicly traded on the NASDAQ under the ticker symbol "LYFT." The company's stock price is influenced by various factors, including supply and demand dynamics, overall market conditions, and company-specific performance indicators. As of the latest trading session, Lyft's stock price stands at [insert current price], reflecting the latest trends in the market.

Investors often track Lyft's stock price movements closely, as it serves as an indicator of investor sentiment towards the company and the ride-sharing sector as a whole. The stock has experienced fluctuations since its IPO, making it essential to analyze the underlying reasons for these changes.

2. Historical Stock Performance

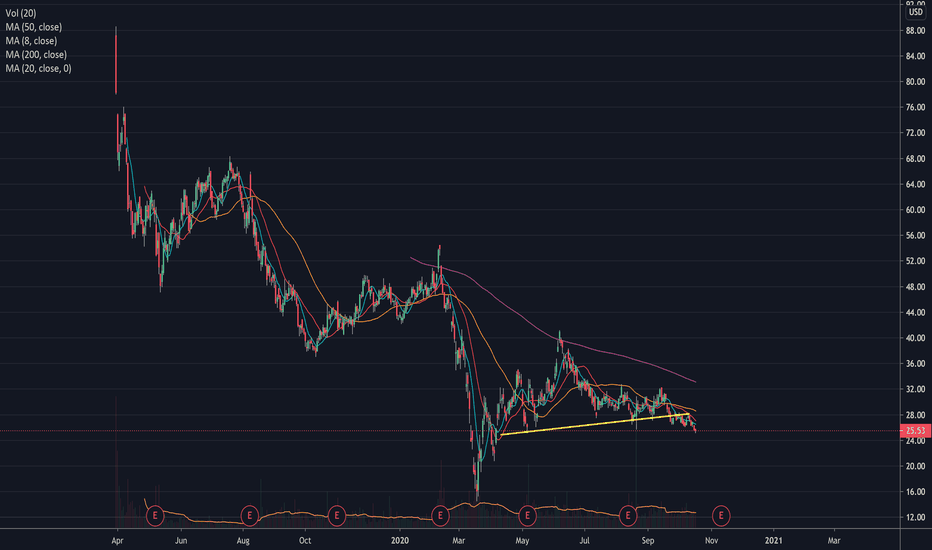

Since its IPO in March 2019, Lyft's stock has encountered various highs and lows. Initially, the stock opened at $72 per share but quickly saw a decline, reaching its lowest point at approximately $10 per share in [insert date]. Understanding the historical performance of Lyft's stock can offer valuable insights into its current situation.

Key Milestones in Lyft's Stock History

- IPO Launch: Lyft went public on March 29, 2019.

- First Quarter Performance: The stock peaked at $88 shortly after the IPO.

- COVID-19 Impact: The pandemic severely affected ride-sharing services, leading to a significant drop in stock price.

- Recovery Phase: Post-pandemic recovery efforts have shown some positive trends in the stock price.

3. Financial Analysis

To understand Lyft's stock price, it is crucial to conduct a financial analysis. This includes evaluating the company's revenue, profitability, and overall financial health. Lyft's revenue streams primarily come from ride-sharing services, bike and scooter rentals, and partnerships.

Recent Financial Performance

In the most recent fiscal year, Lyft reported revenues of [insert revenue figure], reflecting a [insert percentage] increase compared to the previous year. However, the company still faced challenges in achieving profitability, with a net loss of [insert loss figure]. These financial metrics are vital in assessing the stock's value and potential for growth.

4. Market Competition

Lyft operates in a highly competitive environment, primarily facing competition from Uber Technologies, Inc., which dominates the ride-sharing market. Other emerging players in the sector also pose challenges to Lyft's market share.

Competitive Landscape

- Uber: The largest competitor with a significant market presence.

- Other Ride-Sharing Services: Companies like DoorDash and Bolt have gained traction in specific markets.

- Regional Competitors: Localized services may impact Lyft's growth in certain areas.

5. Economic Factors Influencing Lyft

The stock price of Lyft is significantly impacted by broader economic factors such as consumer spending, fuel prices, and regulatory changes. Understanding these factors can provide insights into potential stock price movements.

Key Economic Indicators

- Consumer Spending: A rise in disposable income typically leads to increased demand for ride-sharing services.

- Fuel Prices: Fluctuations in fuel prices can directly affect operational costs for Lyft drivers.

- Regulatory Environment: Changes in regulations can impact the operational landscape for Lyft and its competitors.

6. Strategic Initiatives by Lyft

Lyft's management has implemented several strategic initiatives aimed at enhancing its market position and improving financial performance. These initiatives include expanding service offerings, investing in technology, and focusing on sustainability.

Recent Strategic Moves

- Expansion of Service: Introduction of bike and scooter rentals in urban areas.

- Partnerships: Collaborating with various organizations to enhance service reach.

- Sustainability Efforts: Commitment to reducing carbon emissions through green initiatives.

7. Future Outlook for Lyft Stock

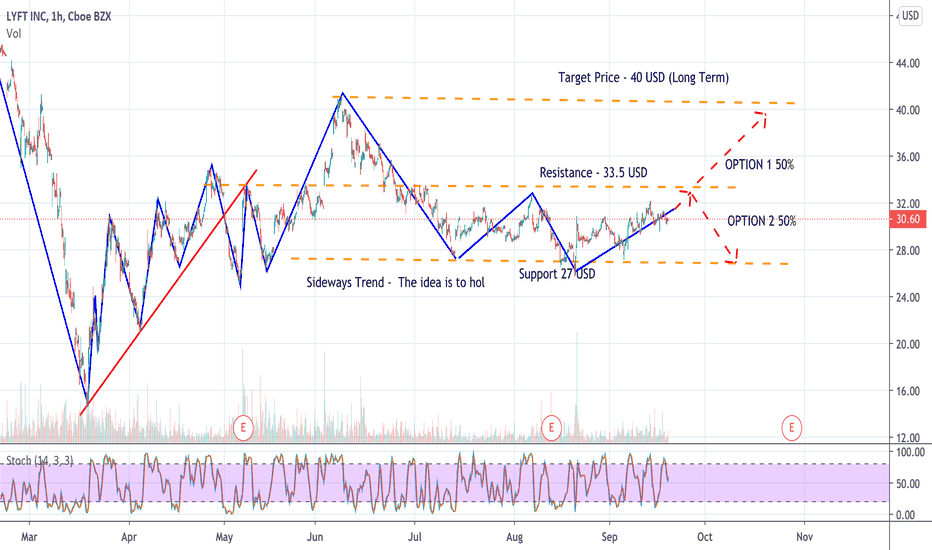

The future outlook for Lyft's stock price remains a topic of speculation among analysts and investors. Factors such as market trends, economic conditions, and company performance will play crucial roles in determining the stock's trajectory.

Analysts project that Lyft could experience [insert projected growth rate or price target] in the coming years, provided that it successfully navigates competitive pressures and continues to innovate its services.

8. Conclusion

In summary, the Lyft stock price is influenced by a multitude of factors, including historical performance, financial health, market competition, and economic conditions. Investors must stay informed and conduct thorough analyses to make informed decisions regarding their investments in Lyft. As the ride-sharing industry evolves, Lyft's ability to adapt and innovate will be key to its long-term success.

We encourage readers to share their thoughts on Lyft's stock performance in the comments below and explore more articles on our site for further insights into investment opportunities.

Final Thoughts

Thank you for taking the time to read this comprehensive analysis of Lyft's stock price. We hope you found the information valuable and insightful. Be sure to check back for more updates and articles that can assist you in your investment journey!

Understanding The Gaza-Israel War: A Comprehensive Analysis

Myles Turner: The Rising Star Of The NBA

Understanding HP Stock: An In-Depth Analysis For Investors