Understanding CVNA Stock Price: Insights And Analysis

The CVNA stock price has become a significant point of interest for investors and market analysts alike. As the parent company of Carvana, a leading online platform for buying and selling used cars, the stock's movements reflect both the company's performance and broader trends in the automotive industry. In this article, we will delve deeply into the factors affecting CVNA's stock price, analyze its historical performance, and provide insights that can aid potential investors in making informed decisions.

The automotive market has been undergoing substantial changes in recent years, with the rise of e-commerce and shifting consumer preferences. This evolution has placed companies like Carvana at the forefront of innovation, making the CVNA stock price a key indicator of the company’s potential growth and future profitability. Understanding the dynamics of CVNA stock is crucial for anyone interested in the intersection of technology, retail, and automotive sectors.

In this comprehensive guide, we will explore various aspects of CVNA stock price, including its historical trends, market analysis, and expert opinions. We will also provide valuable resources and data to support our observations, ensuring that you have all the information needed to navigate your investment journey successfully.

Table of Contents

- 1. Overview of Carvana and CVNA Stock

- 2. Historical Performance of CVNA Stock

- 3. Factors Influencing CVNA Stock Price

- 4. Market Trends in the Automotive Industry

- 5. Expert Analysis and Forecasts

- 6. Risks and Considerations for Investors

- 7. How to Invest in CVNA Stock

- 8. Conclusion and Final Thoughts

1. Overview of Carvana and CVNA Stock

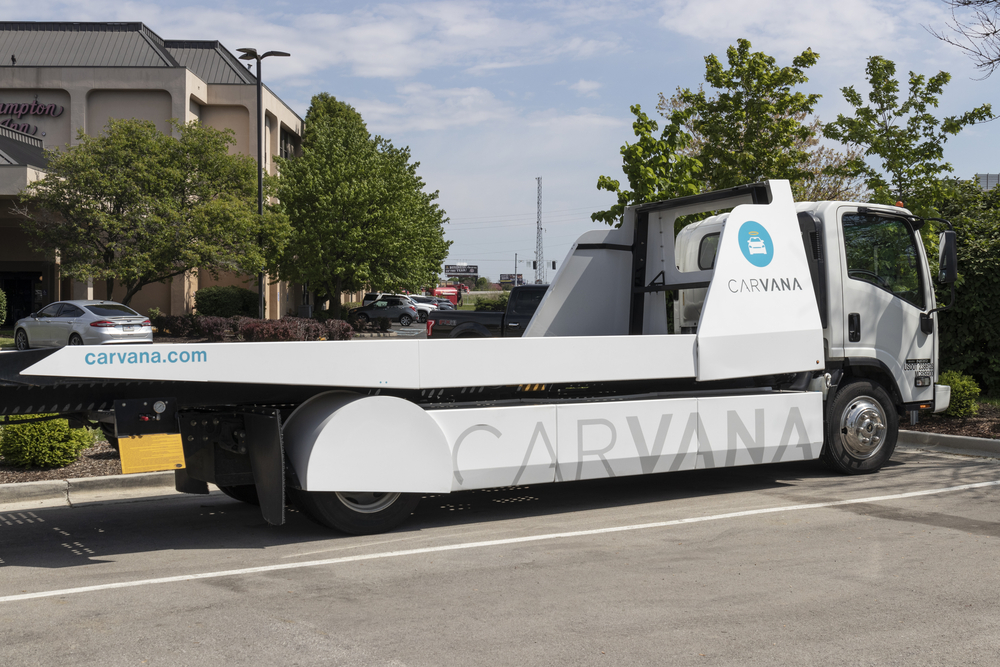

Carvana Co. is an American e-commerce company that specializes in the sale of used cars. Founded in 2012, it has revolutionized the way consumers buy and sell vehicles by offering a fully online platform. The company's stock, traded under the ticker symbol CVNA, has attracted significant attention from investors looking for growth opportunities in the tech-driven automotive sector.

1.1 Key Information about Carvana

| Detail | Information |

|---|---|

| Founded | 2012 |

| Headquarters | Phoenix, Arizona, USA |

| CEO | Ernie Garcia III |

| Stock Symbol | CVNA |

| Industry | Automotive E-commerce |

2. Historical Performance of CVNA Stock

Since its initial public offering (IPO) in 2017, CVNA stock has experienced significant volatility. The stock price surged dramatically during the COVID-19 pandemic as consumers turned to online shopping, but it has also faced challenges as the market began to normalize.

To understand the historical performance of CVNA stock, let’s consider the following:

- IPO Price: Carvana went public at $15 per share.

- All-Time High: The stock reached an all-time high of approximately $360 in August 2021.

- Recent Trends: As of late 2023, the stock has seen fluctuations, making it essential for investors to analyze its performance carefully.

3. Factors Influencing CVNA Stock Price

Several factors can influence the CVNA stock price, including:

- Market Demand: Increased consumer interest in online car purchases can lead to higher stock prices.

- Financial Performance: Earnings reports and revenue growth are critical indicators for investors.

- Competitive Landscape: The actions of competitors in the automotive e-commerce space can impact Carvana’s market position.

- Economic Conditions: Factors such as interest rates and consumer spending can significantly affect the stock price.

3.1 Recent Developments Impacting CVNA

Recent developments, such as strategic partnerships and technological advancements, can also play a crucial role in shaping investor sentiment and market perception of CVNA stock.

4. Market Trends in the Automotive Industry

The automotive industry is experiencing rapid changes, particularly due to the rise of electric vehicles (EVs) and increased digitalization. Understanding these trends is vital for assessing the potential growth of CVNA stock.

- Shift to Online Sales: More consumers are opting for online purchasing, a trend that benefits Carvana.

- Growth of Electric Vehicles: Carvana’s adaptation to EV sales can influence its market position and stock performance.

- Supply Chain Challenges: Issues faced by the automotive supply chain can affect inventory and pricing strategies.

5. Expert Analysis and Forecasts

Expert analysts provide valuable insights into CVNA stock, often issuing buy, hold, or sell ratings based on comprehensive evaluations of the company's performance and market conditions. Here are some key points from recent analyses:

- Several analysts have expressed optimism about Carvana's growth potential, citing strong e-commerce trends.

- Some experts warn of potential risks, including competition and economic downturns that could impact consumer spending.

- Forecasts for CVNA stock price vary widely, reflecting differing opinions on market conditions and company strategies.

6. Risks and Considerations for Investors

Investing in CVNA stock comes with inherent risks. Potential investors should consider:

- Market Volatility: The stock has shown significant volatility, which can lead to rapid price changes.

- Regulatory Risks: Changes in regulations affecting the automotive industry could impact business operations.

- Technological Risks: Failing to keep pace with technological advancements may hinder Carvana's competitive edge.

7. How to Invest in CVNA Stock

Investing in CVNA stock requires careful consideration and understanding of the stock market. Here are some steps to consider:

- Research: Conduct thorough research on Carvana's financial health and market position.

- Consult Financial Advisors: Seek advice from financial professionals to tailor your investment strategy.

- Diversify Your Portfolio: Ensure that your investment in CVNA is part of a diversified portfolio to manage risk.

8. Conclusion and Final Thoughts

In conclusion, the CVNA stock price reflects a dynamic interplay of various factors, including market demand, competitive landscape, and broader economic conditions. By understanding these elements, investors can make informed decisions regarding their investments in Carvana.

We encourage readers to stay updated with market trends, seek professional advice, and engage in discussions about their investment strategies. Your insights and experiences can enrich our community, so feel free to leave your comments below and share this article to help others navigate the world of investing.

Thank you for reading, and we look forward to welcoming you back for more insightful content!

DPLS Stock: A Comprehensive Guide To Understanding DPLS And Its Market Potential

Tekken 8: The Next Chapter In The Iconic Fighting Game Series

Discovering Fzrox: An In-Depth Exploration Of A Rising Star In The Digital Landscape