Understanding HYG Stock: A Comprehensive Guide For Investors

HYG stock, representing the iShares iBoxx High Yield Corporate Bond ETF, has become a focal point for investors seeking opportunities in the high-yield bond market. With the increasing volatility in the financial markets, understanding the intricacies of HYG stock is essential for making informed investment decisions. This article delves into the various aspects of HYG stock, including its performance, structure, and how it fits into an investment portfolio.

The high-yield bond market, often referred to as "junk bonds," offers investors the chance to earn higher returns due to the increased risk associated with these securities. HYG stock allows investors to gain exposure to this market without having to pick individual bonds. As we explore HYG stock further, we will cover its historical performance, benefits, risks, and strategies for investing.

In this comprehensive guide, we aim to equip you with the knowledge needed to navigate the complexities surrounding HYG stock. Whether you're a seasoned investor or just starting out, understanding HYG can help you make more strategic investment choices.

Table of Contents

- What is HYG Stock?

- Biography of HYG

- Performance of HYG Stock

- Benefits of Investing in HYG Stock

- Risks Associated with HYG Stock

- How to Invest in HYG Stock

- Market Outlook for HYG Stock

- Conclusion

What is HYG Stock?

HYG stock is an exchange-traded fund (ETF) that tracks the performance of the iBoxx $ High Yield Corporate Bond Index. This index includes a diverse range of high-yield corporate bonds, providing investors with exposure to the high-yield market.

Investors in HYG stock can benefit from the potential for higher returns compared to traditional bonds, as well as diversification across various sectors. The ETF structure allows investors to buy and sell shares easily on the stock market, providing liquidity and flexibility.

Biography of HYG

| Attribute | Details |

|---|---|

| Fund Name | iShares iBoxx High Yield Corporate Bond ETF |

| Ticker Symbol | HYG |

| Inception Date | April 4, 2007 |

| Asset Class | Bond ETF |

| Expense Ratio | 0.49% |

| Average Daily Volume | 10 million shares |

Performance of HYG Stock

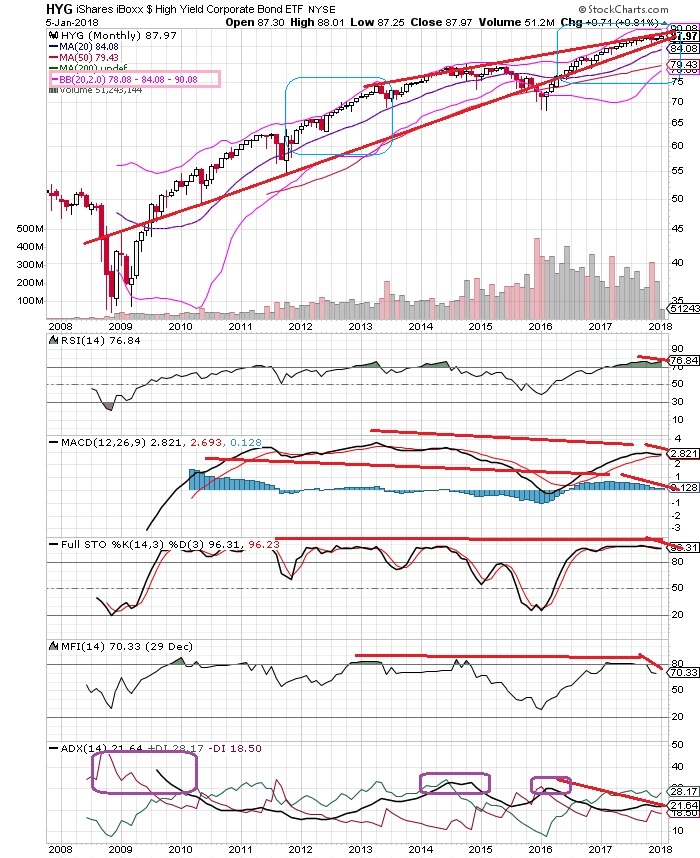

The performance of HYG stock is influenced by various factors, including interest rates, credit spreads, and overall economic conditions. Historically, HYG has provided attractive yields, particularly during periods of economic expansion.

Investors should monitor the performance of HYG stock closely, as changes in the credit market can lead to significant price fluctuations. Reviewing historical data can offer insights into how HYG has performed in different market environments.

Historical Returns

- Annualized Return (Last 5 Years): Approximately 6.5%

- Annualized Return (Last 10 Years): Approximately 5.8%

Benefits of Investing in HYG Stock

Investing in HYG stock offers several advantages for those looking to diversify their portfolios:

- Higher Yield: HYG typically offers a higher yield compared to investment-grade bonds.

- Diversification: Exposure to a wide range of corporate bonds reduces individual bond risk.

- Liquidity: Being an ETF, shares can be bought and sold easily on the stock market.

Risks Associated with HYG Stock

While HYG stock presents opportunities, it is essential to consider the risks involved:

- Credit Risk: High-yield bonds carry a greater risk of default compared to investment-grade bonds.

- Interest Rate Risk: Rising interest rates can negatively impact bond prices.

- Market Volatility: HYG stock can experience significant price fluctuations in turbulent market conditions.

How to Invest in HYG Stock

Investing in HYG stock is relatively straightforward. Here are the steps to consider:

- Open a Brokerage Account: Choose a reputable brokerage that offers access to ETFs.

- Fund Your Account: Deposit funds into your brokerage account.

- Place an Order: Search for HYG stock and place a buy order for the desired number of shares.

Market Outlook for HYG Stock

The market outlook for HYG stock will depend on various economic indicators, including interest rates, inflation, and corporate earnings. Analysts often monitor these metrics to gauge potential movements in the high-yield bond market.

Staying informed about macroeconomic trends is crucial for anticipating how HYG stock may perform in the future.

Conclusion

In summary, HYG stock represents an appealing investment option for those seeking higher yields in the fixed-income market. However, potential investors should carefully weigh the benefits and risks associated with high-yield bonds. By understanding the intricacies of HYG stock, you can make more informed decisions that align with your financial goals.

We encourage you to leave comments, share this article, or explore more articles on our site to enhance your investment knowledge further.

Thank you for taking the time to read this guide on HYG stock. We look forward to providing you with more valuable insights in the future!

2015 Lexus RX 350: A Comprehensive Review

How Much Does Dwayne Johnson Have? A Deep Dive Into His Wealth

Bo Nix: The Rise Of A College Football Star