The Stock Price: Understanding Market Dynamics And Influencing Factors

The stock price is a crucial indicator of a company's market performance and investor sentiment. In today's fast-paced financial world, understanding stock prices is essential for investors, analysts, and anyone interested in the economy. This article will delve into the intricacies of stock prices, exploring the factors that influence them, how to analyze stock performance, and the implications for both individual and institutional investors.

As we navigate through the complexities of the stock market, it's important to recognize that stock prices are not just numbers; they reflect a myriad of factors including economic indicators, company performance, market trends, and investor behavior. This article aims to provide a comprehensive overview of these elements, ensuring that you gain a well-rounded understanding of how stock prices are determined and what they signify.

Whether you are a seasoned investor or a newcomer to the stock market, this guide will equip you with the knowledge needed to make informed decisions. Let's embark on this journey to uncover the dynamics behind stock prices and learn how to interpret the signals they send about the health of the market and the economy at large.

Table of Contents

- What is Stock Price?

- Factors Influencing Stock Prices

- Analyzing Stock Prices

- Importance of Stock Price in Investment Decisions

- Common Misconceptions About Stock Prices

- Historical Stock Price Trends

- Tools for Tracking Stock Prices

- The Future of Stock Prices

What is Stock Price?

The stock price represents the current market value of a company's shares. It is determined by the supply and demand for those shares in the stock market. When more investors want to buy a stock than sell it, the price goes up. Conversely, if more investors want to sell a stock than buy it, the price falls.

Key Components of Stock Price

- Market Demand: The desire of investors to purchase shares.

- Market Supply: The availability of shares for sale by existing shareholders.

- Company Performance: Earnings reports, product launches, and other financial indicators that affect investor perception.

- Economic Indicators: Inflation rates, unemployment rates, and overall economic growth influence investor confidence.

Factors Influencing Stock Prices

Stock prices are influenced by a variety of factors, both internal and external. Understanding these factors can help investors make informed decisions.

Internal Factors

- Earnings Reports: Publicly traded companies are required to release quarterly earnings, which can significantly impact stock prices.

- Management Decisions: Strategic decisions made by a company's management team can build or diminish investor confidence.

- Dividends: Companies that pay dividends often see their stock prices rise, as dividends attract income-focused investors.

External Factors

- Market Sentiment: General investor sentiment can drive stock prices up or down, often regardless of a company's fundamentals.

- Economic Conditions: Changes in the economic environment, such as recessions or booms, have a direct effect on stock prices.

- Regulatory Changes: New regulations or changes in government policy can impact stock prices significantly.

Analyzing Stock Prices

Investors use various methods to analyze stock prices, including fundamental analysis and technical analysis.

Fundamental Analysis

This method involves examining a company's financial statements, management team, market position, and overall economic conditions. Key metrics include:

- Earnings per Share (EPS): Indicates a company's profitability.

- Price-to-Earnings Ratio (P/E): Evaluates a company's current share price relative to its earnings.

- Return on Equity (ROE): Measures a company's profitability in relation to shareholder equity.

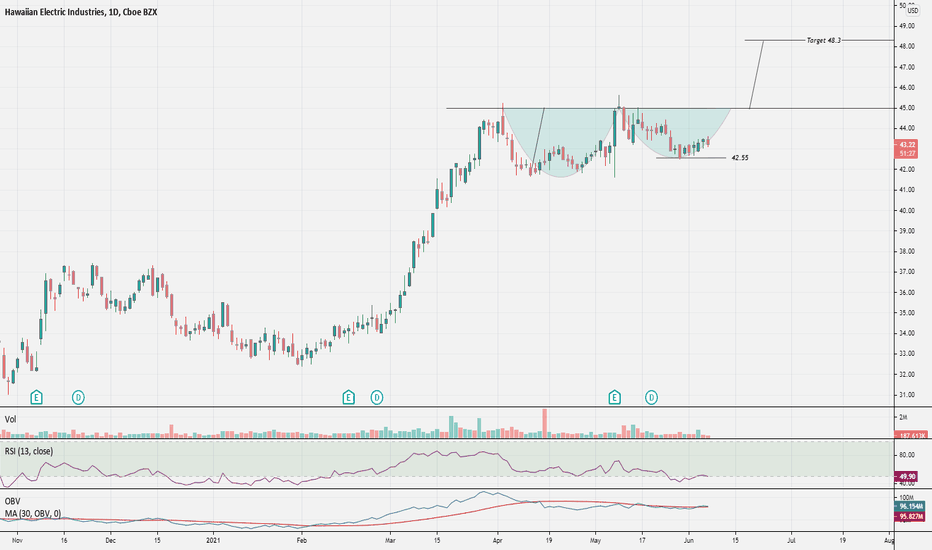

Technical Analysis

Technical analysis focuses on historical price movements and trading volumes to predict future price trends. Analysts use charts and various indicators, such as:

- Moving Averages: Smooth out price data to identify trends.

- Relative Strength Index (RSI): Measures the speed and change of price movements.

- Bollinger Bands: Indicate volatility and potential price movements.

Importance of Stock Price in Investment Decisions

Understanding stock prices is vital for making informed investment decisions. Here are several reasons why:

- Valuation: Investors assess whether stocks are overvalued or undervalued based on stock prices.

- Portfolio Management: Stock prices help investors determine when to buy or sell shares to optimize their portfolio.

- Market Trends: Analyzing stock prices can reveal broader market trends and potential investment opportunities.

Common Misconceptions About Stock Prices

There are several misconceptions surrounding stock prices that can mislead investors:

Misperception of Price as Value

Many investors equate stock price with value, overlooking the importance of a company's fundamentals.

Short-Term Focus

Some investors focus solely on short-term stock price movements, neglecting long-term trends and company performance.

Historical Stock Price Trends

Examining historical stock price trends can provide valuable insights into market behavior and investor psychology. Significant events, such as financial crises and technological advancements, have shaped stock prices over time.

Case Study: The Dot-Com Bubble

The late 1990s saw inflated stock prices driven by speculation in technology stocks, leading to a significant market crash in 2000.

Impact of Financial Crises

Financial crises often lead to drastic declines in stock prices, as seen during the 2008 financial crisis. Understanding these trends can help investors prepare for future market fluctuations.

Tools for Tracking Stock Prices

There are numerous tools and resources available for tracking stock prices:

- Stock Market Apps: Applications like Robinhood or E*TRADE provide real-time stock price updates.

- Financial News Websites: Websites such as Bloomberg and Yahoo Finance offer comprehensive stock market coverage.

- Brokerage Platforms: Many brokerage firms offer tools for analyzing and tracking stock prices.

The Future of Stock Prices

The future of stock prices will likely be influenced by technological advancements, changing economic conditions, and evolving investor behavior. As artificial intelligence and machine learning become more prominent in trading strategies, the landscape of stock prices may change dramatically.

Emerging Technologies

Technologies such as blockchain and AI are set to revolutionize the way stock markets operate, potentially leading to more efficient pricing mechanisms.

Global Economic Trends

As economies become more interconnected, global events will increasingly impact stock prices, making it essential for investors to stay informed about international developments.

Conclusion

Understanding stock prices is essential for anyone involved in the financial markets. By recognizing the factors that influence stock prices, utilizing effective analysis techniques, and staying informed about market trends, investors can make more informed decisions. Remember, the stock price is not just a number; it is a reflection of a company's health and the market's perception of its future.

We encourage you to explore further, leave your comments, and share this article to help others gain insights into the world of stock prices. For more information, check out our other articles on investment strategies and market analysis.

Penutup

Thank you for taking the time to read this article on stock prices. We hope you found it informative and inspiring. Be sure to visit our site again for more insights and updates on the ever-evolving world of finance and investment.

Understanding SunPower Stock: A Comprehensive Guide For Investors

Congressional District News: Staying Informed About Your Local Government

Tennessee Titans News: Latest Updates And Insights

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/52d86652-ba2b-43fe-a8fc-523af1fa6e47.jpg)