The Ultimate Guide To Mint Budget App: Master Your Finances With Ease

In today's fast-paced world, managing your finances effectively is more important than ever, and the Mint Budget App stands as a powerful tool for achieving financial stability. This comprehensive guide will delve into the features, benefits, and practical tips for using the Mint Budget App to its fullest potential. By the end of this article, you'll have a thorough understanding of how this app can help you take control of your financial life.

Whether you're looking to track your spending, create a budget, or plan for future expenses, the Mint Budget App offers a user-friendly interface and a plethora of features designed to streamline your financial management. In this article, we will explore the app's capabilities, share expert tips, and provide valuable insights into how you can leverage this tool for your financial well-being.

Join us as we embark on this journey to financial empowerment, and discover why the Mint Budget App is a favorite among users seeking to simplify their budgeting process. With its robust features and intuitive design, this app is a must-have for anyone serious about managing their money effectively.

Table of Contents

- Overview of Mint Budget App

- Key Features of Mint Budget App

- How to Use Mint Budget App

- Benefits of Using Mint Budget App

- Expert Tips for Maximizing Mint Budget App

- Common Issues and Troubleshooting

- Security and Privacy Concerns

- Conclusion

Overview of Mint Budget App

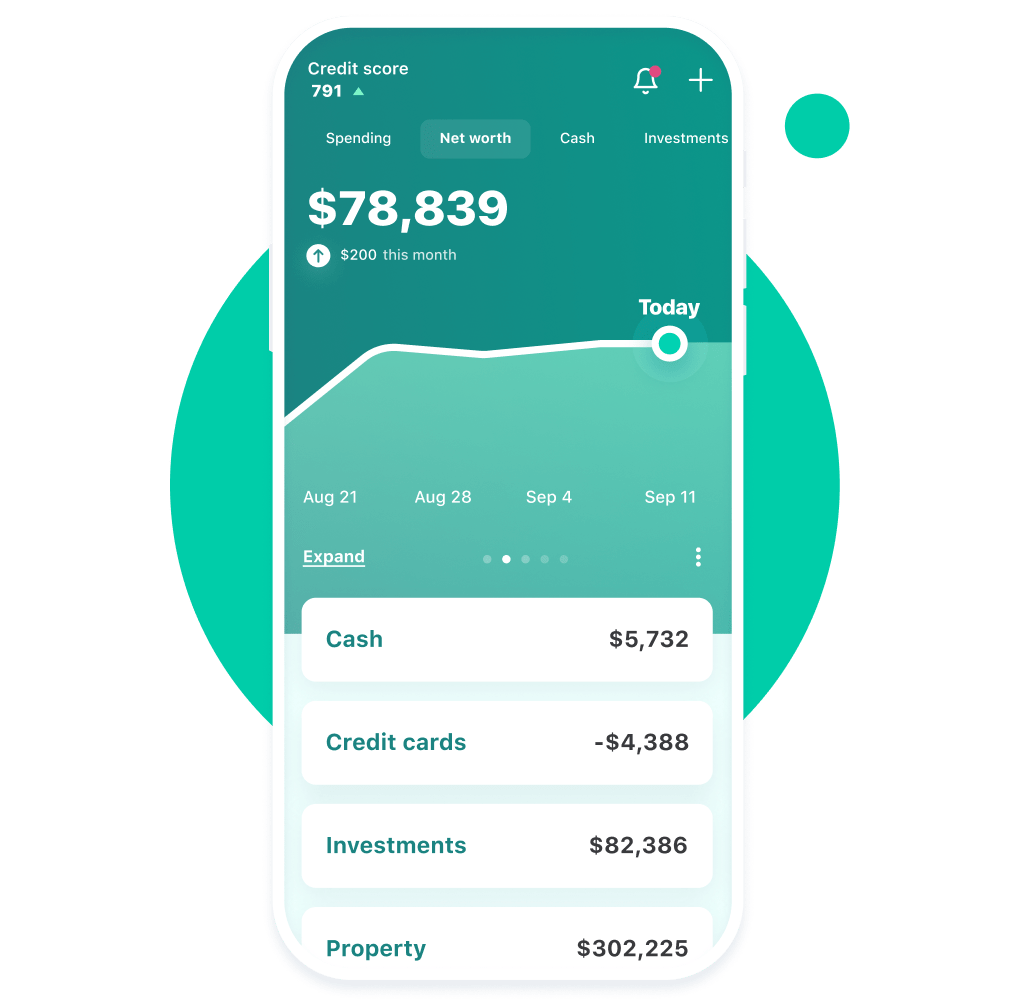

The Mint Budget App is a comprehensive financial management tool developed by Intuit that helps users track their expenses, create budgets, and monitor their financial health. Launched in 2006, Mint has become one of the most popular budgeting apps in the market, with millions of users benefiting from its features.

Mint allows users to link their bank accounts, credit cards, and other financial institutions, automatically categorizing transactions and providing insights into spending habits. By centralizing financial information, users can make informed decisions about their budgets and savings goals.

Key Features of Mint Budget App

Mint Budget App is packed with features designed to simplify financial management. Here are some of the key features:

- Account Linking: Connects to various financial institutions to track spending in one place.

- Automatic Categorization: Automatically categorizes transactions into predefined categories.

- Budget Creation: Allows users to set up customizable budgets based on spending habits.

- Spending Insights: Provides detailed reports and insights into spending patterns.

- Bill Tracking: Sends reminders for upcoming bills to prevent late payments.

- Credit Score Monitoring: Offers free access to your credit score and tips for improvement.

- Goal Setting: Enables users to set financial goals and track progress.

How to Use Mint Budget App

Getting Started with Mint

To begin using the Mint Budget App, follow these simple steps:

- Download the Mint app from the App Store or Google Play.

- Create an account by providing your email address and creating a password.

- Link your bank accounts and credit cards by entering your credentials securely.

- Set up your budget by categorizing your expenses and defining spending limits.

Tracking Your Expenses

Once your accounts are linked, Mint will automatically track and categorize your transactions. You can view your spending in real-time and adjust your budget as needed. The app also allows you to manually add expenses that may not be automatically categorized.

Benefits of Using Mint Budget App

Using the Mint Budget App comes with several advantages that can contribute to better financial management:

- User-Friendly Interface: The app is designed to be intuitive and easy to navigate.

- Time-Saving: Automatic tracking and categorization save time and effort in budgeting.

- Financial Insights: Provides valuable insights into spending habits, helping users make informed decisions.

- Goal-Oriented: Encourages users to set and achieve financial goals.

- Free to Use: The app is free, with no hidden fees or subscriptions.

Expert Tips for Maximizing Mint Budget App

To get the most out of the Mint Budget App, consider these expert tips:

- Regularly review and adjust your budget based on changing expenses.

- Take advantage of the goal-setting feature to stay motivated.

- Utilize the bill reminder feature to avoid late fees.

- Monitor your credit score and take steps to improve it.

Common Issues and Troubleshooting

While the Mint Budget App is generally reliable, users may encounter some common issues:

- Account Linking Problems: Sometimes, users may have difficulty linking accounts. Ensure you are using the correct login credentials.

- Transaction Categorization Errors: If transactions are miscategorized, you can manually edit them within the app.

- App Crashes: If the app crashes, try clearing the cache or reinstalling the app.

Security and Privacy Concerns

Security is a top priority for Mint, which employs bank-level encryption to protect user data. However, users should also take precautions, such as:

- Using strong, unique passwords for their Mint account.

- Enabling two-factor authentication for added security.

- Regularly monitoring account activity for any suspicious transactions.

Conclusion

In conclusion, the Mint Budget App is a powerful tool for anyone looking to take control of their finances. With its comprehensive features, user-friendly interface, and insightful analytics, it empowers users to make informed financial decisions. By following the tips and guidelines outlined in this article, you can maximize your experience with Mint and achieve your financial goals.

We encourage you to try the Mint Budget App today and start your journey towards financial freedom. If you have any questions or experiences to share, please leave a comment below or share this article with others who may benefit from it.

Thank you for reading, and we look forward to seeing you back on our site for more valuable financial insights!

Blake Martinez: The Journey Of An NFL Linebacker

Exploring The Rise Of Hockenson Bussin: A Cultural Phenomenon

Harley Quinn Season 4: A Deep Dive Into The Chaos And Charm